It’s a complex dilemma for Saudi Arabia. Earlier this month, some observers, including politicians and media outlets, interpreted any OPEC+ cuts as an act of weaponizing oil in response to Western support for Israel as it fights Hamas in Gaza. Now, however, a temporary ceasefire has been reached. Amid the negotiations related to the Israel-Hamas war, Saudi Arabia and its allies can go for additional cuts next week and avoid being accused of weaponizing oil. But it doesn’t end here. If OPEC+ increases production instead, some will argue that Saudi Arabia weaponized oil to punish cheaters and shale producers. And if the oil group rolls over the voluntary cuts, others will claim that Saudi Arabia is losing market share to other oil producers. In any case, Saudi Arabia will come under criticism.

Strangely enough, OPEC+ is in the same position as in around a year ago when the group made two miscalculations: it did not cut production, and it eliminated the monthly meetings. OPEC+ later corrected both missteps in March 2023, but after paying a heavy price in the first quarter. On December 3, 2022, we warned in our EOA newsletter that if OPEC+ did not cut production, oil prices were going to decline. We said:

“OPEC+ needs to flip the futures curve from contango to a steep backwardation by cutting production. Otherwise, oil prices will decline further in the coming weeks.” Prices declined by about $10 in the first quarter of 2023.

We believe that OPEC+ learned the lesson last year and does not want to repeat the same mistake, especially since Russian oil production has not declined as much as some pundits had expected.

In today’s report, we share with our readers three scenarios for what could come next when OPEC+ meets on November 30.

Three Scenarios

OPEC+ is currently facing headwinds from the demand side: demand growth is weaker than earlier expectations, and global demand is expected to decline seasonally in the first quarter of 2024. The increase in non-OPEC production is not a problem for OPEC since it has been expecting such increases since last year, as we discussed in yesterday’s report. Before OPEC+ delayed its meeting, our main scenario focused on extending or deepening voluntary cuts with no agreement among OPEC+ members on new reductions. However, the delay now makes the probability of a new cut by OPEC members higher than before.

Before we discuss the three scenarios, let’s review the forecasts of the International Energy Agency (IEA), OPEC, and the US Energy Information Administration (EIA) for 2024 to better understand the OPEC+ position.

Table (1) below summarizes the forecasts of demand and non-OPEC production by the IEA, OPEC, and EIA. It also calculates the “call on OPEC and inventory change.” The most important information is in row ‘H’ which shows how much OPEC production and inventories have to change relative to the October data. According to the IEA, to keep global oil inventories flat at October levels, OPEC has to cut production by 510, 000 b/d. If the IEA forecast is correct, OPEC has to cut output by more than that amount if it wants to lower inventories.

Meanwhile, according to the EIA, additional cuts would lower inventories. Without additional cuts, inventories will remain virtually flat.

Here we have the IEA and EIA showing the importance of additional cuts. That is not the case with OPEC forecasts! OPEC forecasts are against any cuts! OPEC’s data shows that if OPEC keeps production flat, global oil inventories will decline by 1.73 mb/d (In other words, it calls for an increase in OPEC production). OPEC has been way off in its forecasts. In fact, if OPEC+ decides to go for additional cuts, it will prove that OPEC demand forecasts have been wrong. This is an indication that Saudi Arabia has its own forecasts that are different from those of OPEC.

We have plotted three scenarios for what could be announced on November 30 when OPEC+ members meet virtually:

Scenario 1

OPEC+ will enforce earlier cuts and deepen them. Given that some producers do not want to cut output, and since any decision has to be unanimous, disputes can be worked out by “tweaking” production baselines and through other approaches to resolve disputes among members as we saw happen on various occasions in the past. The result in this case would be an additional overall cut but actual cuts will be made only by large producers. Tweaking production baselines may not lead to a change in the production of members who have been refusing to cut production, and Saudi Arabia may not have a problem with that as long as it can obtain a unified decision and send a positive message to the market.

The possibility of Saudi Arabia offering a second “lollipop” is also high: after the agreement, they could announce additional voluntary cuts for January or the first quarter. This should flip the prompt month of the futures curve from contango to backwardation (now the front two months are in contango and the rest of the curve in backwardation). Saudi Arabia needs the steep backwardation in the prompt month to be able to influence market balances and market sentiment. This can be accomplished if the total new cuts are around 1.5 mb/d from October levels.

Flipping the front month to steep backwardation and keeping that way month after month would reduce global inventories by forcing storage liquidation on one hand and preventing storage build on the other. The impact on E&P investment is unclear: it increases investment above a certain price level and reduces it under a certain price level. In our view, the 24-month Brent strip has to be above $85 to see a continuous increase in E&P investment.

Scenario 2

If OPEC+ members do not agree on a cut, Saudi Arabia and its allies will extend the voluntary cuts to January or the first quarter of 2024. While this is the easiest decision, it may not lead to prompt month backwardation. In contango, Saudi Arabia will be forced to share the driver’s seat with speculators. This brings us to the third scenario.

Scenario 3

In this scenario, OPEC as a group will NOT agree on additional cuts. Instead, Saudi Arabia and its allies within OPEC+ will deepen the existing voluntary cuts to eliminate surpluses on the one hand and force backwardation in the prompt month on the other.

A few days ago, we eliminated the possibility of Scenario 1 because some producers were not willing to accept any proposed production reductions. OPEC+ is currently working to change the production baselines of some members so that they agree to a cut, and that’s why Scenario 1 now takes center stage.

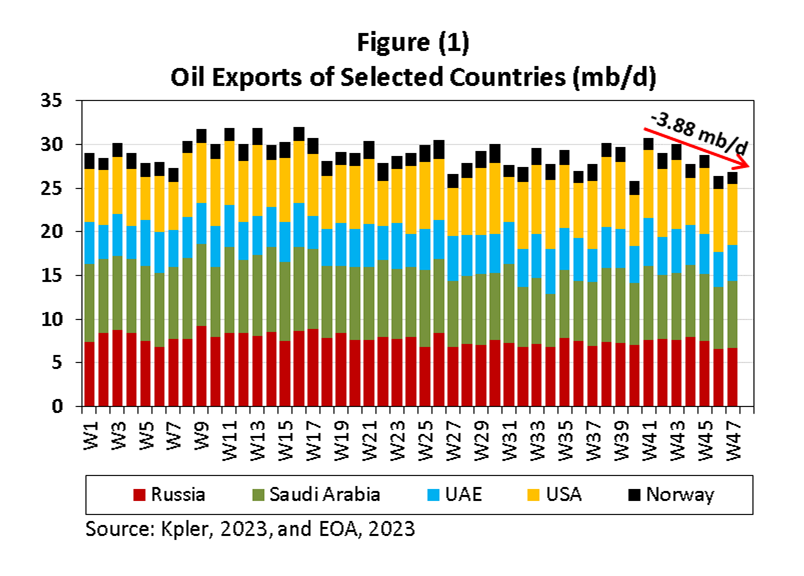

Regardless of the outcome, all three scenarios will find support on the ground since oil exports of major exporters inside and outside OPEC+ have been declining in recent weeks. In the last six weeks, exports from Russia, Saudi Arabia, the UAE, the US, and Norway declined by 3.88 mb/d. If OPEC+ cuts one way or the other, exports will continue to decline.

Importance of Delaying OPEC+ Meeting

While delaying the OPEC+ meeting until November 30 will give members time to iron out differences regarding quotas and baselines, it will also give them a better view of November’s oil data. In addition, the meeting will be close to the date when Aramco announces its January OSPs (usually on the 5th of each month). As we mentioned in previous reports, Aramco’s OSPs have been used as a policy tool since last year. If OPEC+ agrees to a cut and Saud Arabia announces an extension of its current voluntary cuts, while adding a “lollipop”, Aramco will most likely increase its OSPs, especially to Asia.

Additionally, it’s our opinion that the OPEC+ meeting had to be postponed given that oil prices plummeted suddenly, and Saudi Arabia and its allies needed more time to fight the fast decline amid other events in the region as we discuss below.

Virtual Meeting

The OPEC+ meeting on November 30 will be held virtually and it will coincide with another major conference in the region, COP28 in Dubai which will be attended by some OPEC+ ministers. Other gatherings will follow, including the GPCA annual conference in Doha on December 3-5, as well as the OAPEC conference that is scheduled for December 12-13 in the Qatari capital. These venues can provide opportunities for additional discussions regarding the oil market if needed.

A virtual meeting means it will be short and only to confirm a decision that is currently being formed. While OPEC+ unity is one of Saudi Arabia’s key objectives, we cannot rule out the possibility of a Saudi surprise to support that unity.

Conclusions

OPEC+ is back to square one— exactly where it was last December. One way or another, the group will now go for a cut to avoid the mistake that was made last year when OPEC+ decided NOT to cut production.

If we end up with Scenario 1 which includes a “lollipop”, we will most likely see a rise in oil prices with the futures curve flipping the prompt month from contango to backwardation. But this scenario carries a problem: It contradicts OPEC’s optimistic forecast of global oil demand growing by 2 mb/d YoY in the first quarter of 2024. We still believe that OPEC’s estimates of demand growth in 2023 were optimistic and higher than actual. Currently, the difference between OPEC’s estimates of the Call on OPEC/change in inventories and actual production is about 2 mb/d. We know for a fact that inventories did not decline by that amount, and for this reason, demand has been overestimated.

While Scenarios 2 and 3 will raise prices, the increase will be limited, and Saudi Arabia will not obtain the backwardation they need to lead the market. To achieve higher prices and backwardation, the additional cuts need to be around 1.5 mb/d or higher for the first quarter of 2024. OPEC+ can later increase production throughout the year. EOA