Early Signs of Recovery in China’s Gas Demand

6%-10% growth is expected in 2023 (with 3 charts)

Related Topics:

Busting Myths about China’s Oil Demand and Imports

US Keeps Top LNG Supply Spot in H1 2023

Oman LNG Remarkable Success: New Term-Contracts Amid Potential Capacity Boost

Understanding Pricing Mechanisms in International Gas Trade

Last year, China’s natural gas demand declined by 1.2%, reaching 364.3 billion cubic meters (bcm), down from 372 bcm in 2021. This drop was the result of China’s zero-COVID policy which slowed demand in the industry sector, as well as the unprecedented high spot LNG prices following Russia's invasion of Ukraine. Since the start of this year, however, China’s economy has shown some signs of growth in natural gas demand in the electricity, commercial, and residential sectors.

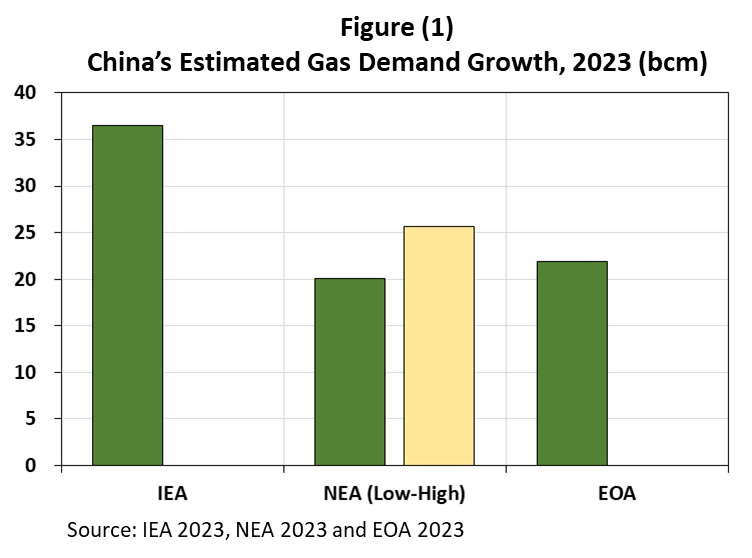

In its recent report on natural gas developments in 2023, China’s National Energy Administration (NEA) estimated that the country’s natural gas consumption is expected to grow by 5.5-7% year-on-year, to reach 385 -390 bcm this year.

In the first half of 2023, China’s gas consumption grew by 5.6% year-on-year to 194.1 bcm. If this level of growth continues in the second half of the year, consumption could reach an all-time high of 385-390 bcm.

Meanwhile, the International Energy Agency (IEA) expected last December that the annual natural gas demand in China would grow by 10% in 2023, which is the most optimistic scenario so far (Figure 1). We have also estimated that gas demand could grow by at least 6% in 2023 as lockdown measures ease and lower LNG prices attract Chinese buyers to purchase more spot cargoes. Both spot and short-term purchases meet over 40% of China’s LNG demand while the remaining demand is met by long-term contracts.

China’s Gas Supply Growth in 2023

Keep reading with a 7-day free trial

Subscribe to Energy Outlook Advisors' Newsletter to keep reading this post and get 7 days of free access to the full post archives.