Greetings from Riyadh, Saudi Arabia.

We believe the “two” meetings are scheduled on a weekend by design while markets are closed to avoid the volatility associated with media leaks and inaccuracies in media reporting. The contradictory news yesterday proves this point.

OPEC+ plans to hold its meeting on June 2. The original meeting was scheduled for June 1, but it was delayed by one day without an official explanation. The meeting was also changed from in-person meeting to virtual, again, without an official explanation. Since yesterday, contradictory rumors have been flying all over social media: the meeting will be in person, in Riyadh, not in Vienna. If this is true, it may explain the delay. The in-person meeting might have been talked about a few days earlier. However, media sources quoted OPEC officials confirming the meeting remains virtual.

Amidst this confusion in the media, it is possible the official OPEC+ meeting will be virtual and short while ministers of countries that participated in the voluntary cuts will meet in person in Riyadh for a longer meeting. Regardless, please keep this in mind: the Hajj season has begun, and most officials move to the holy city of Mecca to ensure the movement of millions of people goes smoothly. All major business in Riyadh must be done quickly in the next couple of days before they leave to Mecca.

We believe the “two” meetings are scheduled on a weekend by design while markets are closed to avoid the volatility associated with media leaks and inaccuracies in media reporting. The meeting comes three days prior to the announcement of Aramco OSPs for July. As we have mentioned in the past, we have to look at a three-leg policy: meeting, pricing, and exports.

Looking at OPEC+ meetings in recent years, we find they have two characteristics:

Forward looking.

Not taking any chances.

Let us remember that there are two types of production cuts:

Cuts that were made by OPEC+ as a group in 2022 and extended to the end of 2024 and

Voluntary cuts that were made by some members starting in 2023 and extended to end of June 2024.

It remains to be seen if these official OPEC+ cuts will be discussed on Sunday or delayed until the end of year meeting. Based on the characteristics mentioned above, we should not be surprised if they are extended to June or December 2025.

However, officially, voluntary cuts have nothing to do with this official meeting of OPEC+. A subgroup of OPEC+ made these voluntary cuts and we suspect, as mentioned above, they might have in-person meeting in Riyadh that has nothing to do with the official meeting of OPEC+. Any announcements of changing/extending the cuts to September or December will be made by individual countries in the hours after this meeting.

To conclude, we expect two meetings. One for OPEC+ as a whole that will most likely be virtual and short. This meeting will have one of two outcomes: either emphasize compliance, or delay extension of the cuts until the next meeting at the end of the year, or extend the cuts to end of June or end of December 2025. Either decision will have no impact on the market in 2024.

The possibility of extending the cuts to 2025 is high, given the two characteristics mentioned above. It is very easy to increase production if the market needs additional supplies, but it is difficult to convince 22 members to quickly cut production. It is easier to extend cuts and when markets need additional production, they can either ignore over-production or decide to “temporarily” increase production. We expect “temporary” increases to be the norm if markets need additional supplies to keep the agreement in place. The idea of “temporary” increases is to keep the agreement in place in case a cut is needed.

The other meeting has nothing to do with the officially scheduled OPEC+ meeting. It is for the ministers (or some of them) of the countries that participated in the voluntary cuts. Theoretically, they have three choices:

Deepen the voluntary cuts

Extend current voluntary cuts

Increase production (Reduce voluntary cuts)

The first choice is out of the question. The third choice is possible but not likely except for exemptions for some participants. The most likely choice is the second: Extend current voluntary cuts to the end of September or December with strong emphasis on compliance and compensation. Since such a decision is widely expected, its impact on the market is limited. However, the true impact should be measured to a market with no voluntary cuts at all. By our estimate, oil prices would have been $20+ lower and way more volatile without these cuts. We warn those who think oil prices in the $50s and $60s are good for the global economy because such prices would destroy massive amount of capital in the oil and gas industry on hand and would reduce E&P investment significantly around the world. For those who care about climate change, lower oil prices would lead to higher oil consumption and slower growth of green alternatives. By default, that means higher CO2 emissions.

Figure (1) below shows trends in OPEC’s crude oil production since 2019. It shows the impact of the official cuts and the voluntary cuts. So far, crude production in 2024 is lower than that of 2023 and 2022 and way lower than pre-COVID levels (2019).

Figure (2) shows crude exports of OPEC+ members. It shows the decline in recent weeks as some countries cut production like Iraq while production declined in places like Nigeria and Venezuela. Production of Russia and Kazakhstan declined markedly in April.

Maintaining the Status Quo is Needed

It is clear that OPEC+ members realize that the only way to reduce volatility and achieve market balance is cooperation. Differences in views and requests for increasing quota do not contradict the idea of “cooperation.”

We do not expect any surprises from this meeting. Continuity is important for market stability at this time, which entails no change in OPEC+ production on one hand and extension of voluntary cuts on the other.

While global oil demand is increasing, it is not high enough to justify an increase in production. We believe countries will start reversing their voluntary cuts under two interrelated conditions: a meaningful increase in global oil demand accompanied by a meaningful decrease in global oil inventories. Both do not exist at this time.

There are diverging points of view about growth in global oil demand. OPEC forecasts global oil demand to grow by 2.2 mb/d in 2024, while the IEA expect the growth to be exactly half of that: 1.1 mb/d (See Figure 3 below). Our own estimate is 1.48 mb/d.

Meanwhile, global oil inventories have been increasing, especially in China and India (see Figure 4 below). US commercial crude inventories are more than 50 mb above the level that will cause a noticeable increase in oil prices (See Figure 5 below).

US oil demand growth remains weak. Although US gasoline demand has been increasing since the beginning of the year, it remains lower than that of 2023 and way lower than pre-COVID levels as shown in Figure (6).

The impact of electric vehicles remains limited. Most of the weak growth in global oil demand is related to slow economic growth around the world. Please bear in mind that global oil demand is, in reality, demand for “liquids,” which includes NGLs and Biofuel. OPEC+ quota focuses on crude (Russia is an exception as we will see below). The world has been experiencing a major increase in biofuel production.

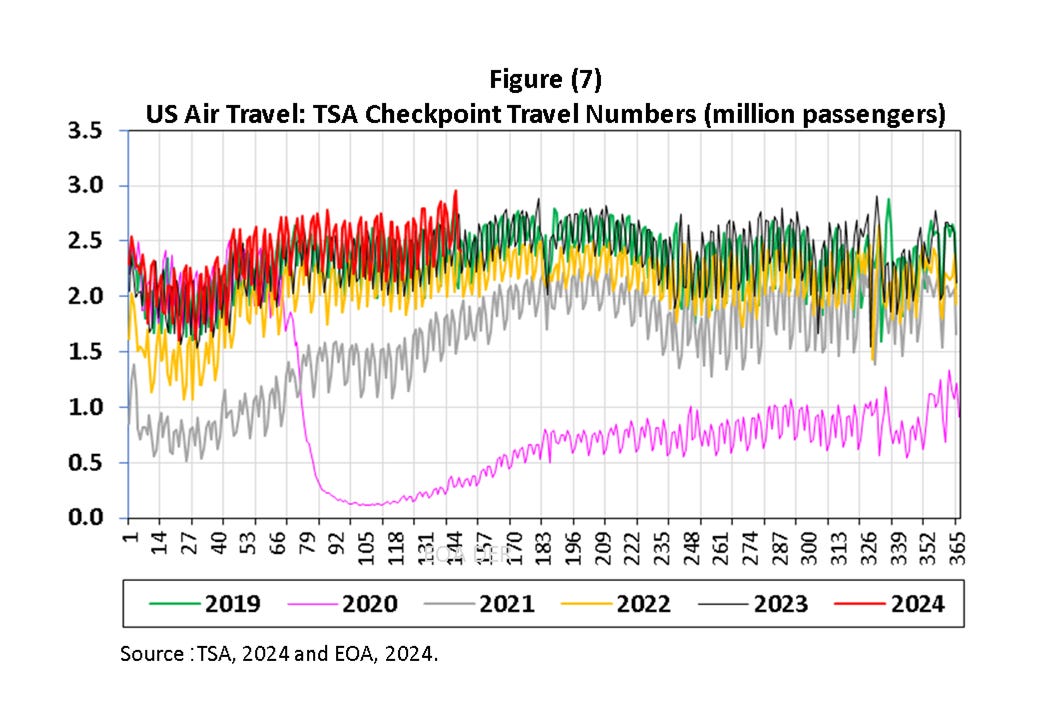

So far this year, the number of US passengers who traveled via air has increased by 6.4% over that of last year and 3.7% of that o 2019. Figure (7) above shows trends in the number of passengers since 2019 and shows that travel has recovered and exceeded pre-COVID levels.

Here is the problem: US jet fuel demand so far this year is flat YoY and lower than pre-COVID-19 levels by 6.2% as shown in Figure (8)! Higher passenger traffic is now being translated into packed planes but no recovery in fuel demand!

Meanwhile, everyone expects a meaningful increase in non-OPEC production. OPEC expects the US, Canda, Brazil, and Norway to add about 1 mb/d in 2024. US crude production is rebounding, though slower than before, but it is at record high for this time of the year as shown in Figure (9) below.

Add the possibility of the Biden Administration withdrawing oil from the Strategic Petroleum Reserves (SPR) in August and September. Our view is that the Biden Administration might withdraw 30-60 mb if WTI reaches $90/b. But there are no rules in politics, and they may withdraw oil from the SPR at even lower prices. If the Biden Administration is going to withdraw oil from the SPR to lower oil prices anyway, why should members of OPEC+ increase production?

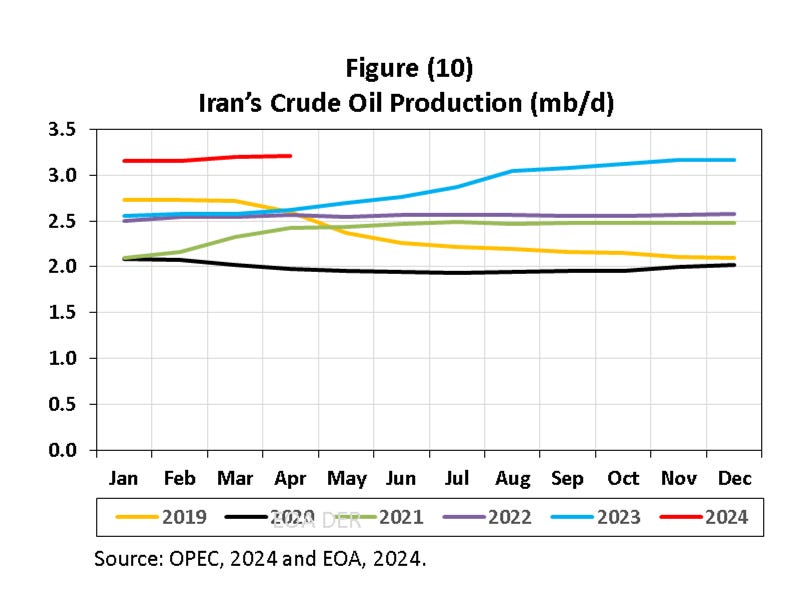

The recent sanctions on Iran and Venezuela by the Biden Administration are toothless and designed to be toothless: Energy politics at its best! No politician wants to see high oil and gasoline prices in an election year.

Figure (10) shows the continuous increase in Iran’s crude oil production Since President Biden came to office. Figure (11) shows the increase in Iran’s crude oil exports. Although sanctions on Russia, Iran, and Venezuela meant that China is getting lower oil prices than others, it also means lower oil prices for everyone since China does not have to compete with Europe and others for oil supplies.

Figure (12) shows the increase in Venezuela’s crude exports. The Biden Administration revoked the general license to export Venezuelan oil, but it is giving individual licenses for any company that was affected by the decision to revoke the general licenses, making the recent decision to reimpose sanctions toothless.

If the exports of Iran and Venezuela are increasing (Both are exempt from OPEC quota) and the recent sanctions are toothless, there is no reason for the rest of OPEC+ to increase production.

Side Issues

We thought a couple of weeks ago that three independent consulting companies will present their findings in the meeting on Sunday regarding production capacity of OPEC+ members which will be used to calculate quotas for members in 2025. Now it is clear that this meeting will kick start this process that might take a long time. Meanwhile, we may hear statements from some countries that they want higher quota in 2025.

The Russian announcements regarding Russia’s voluntary cuts are the most important, especially when it comes to the details of their extended voluntary cuts: crude vs products and production vs exports. OPEC+ agreements, and OPEC before it, have always focused on crude. But Russia has been a special case because of sanctions: how to verify Russian oil production? In addition, the Ukrainian drone attacks on Russian refineries and oil facilities forces Russia to focus on products, not crude. Russian officials want to count this decline as part of their compliance with cuts.

Figure (13) below shows part of the impact of the Ukrainian drone attacks on Russian refineries: Fuel oil exports declined since the attacks started. However, the chart shows the impact of sanctions: Destinations changed.

The Iraq story that it will not extend the voluntary cut beyond June is fake news. The Iraqi oil minister was responding to a question about “deepening” the cuts. The minister responded that Iraq will not agree to “deepen” the cuts. A journalist thought he rejected the “extension” of the voluntary cuts.

Figure (14) below shows Iraq’s oil production since the beginning of 2022. It shows that Iraq’s oil production declined starting in March 2023 when exports from the North through the Pipeline going to the Turkish port Ceyhan stopped. It started declining recently as Iraq started cutting production to comply with its voluntary production cuts. Despite these cuts, Iraq is still over producing by about 200 kbd.

EOA’s Main Takeaways

At the time of this writing, everything that has been reported by the media was rumors. However, it is possible that the official OPEC+ meeting will be virtual while some ministers of countries that made voluntary cuts will meet in Riyadh on Sunday in Person after the virtual official meeting of OPEC+.

However, the possibility that everything remains virtual is still there.

OPEC+ will most likely extend its cut to end of 2025, if not now, in its next meeting. Countries that cut production voluntarily will most likely extend their cuts to September or December. All these acts will have limited impact on the oil market but should add clarity, enhance stability and reduce volatility.

Aside from the extension, we will see emphasis on compliance and how countries that over produced will compensate for over production. Iraq and Kazakhstan have already submitted their plans about two weeks ago. Now it is Russia’s turn. As countries announce their voluntary cuts for the second half of 2024 one after the other, the Russian announcement is the most important.

We expect oil prices to go sideways for the rest of the year. We might see an unexpected uptick in oil demand if spot LNG prices increase over the summer and China manages brownouts in some regions. Under such circumstances, we will see an increase in private generation that will increase demand for certain oil products. EOA