What Does Chinese Oil Data Tell Us about the Oil Market?

Crude imports are at a record high, but questions remain (with 9 charts)

Related Articles:

Busting Myths about China’s Oil Demand and Imports

EOA 2023 Oil Market Outlook: 2023 is a tale of two opposite halves

The Chinese crude oil import data is very bullish, but the shift in sources of imports, rise in inventories, and expected increase in petroleum products exports raise questions about the health of the Chinese oil demand.

1- China’s Oil Imports

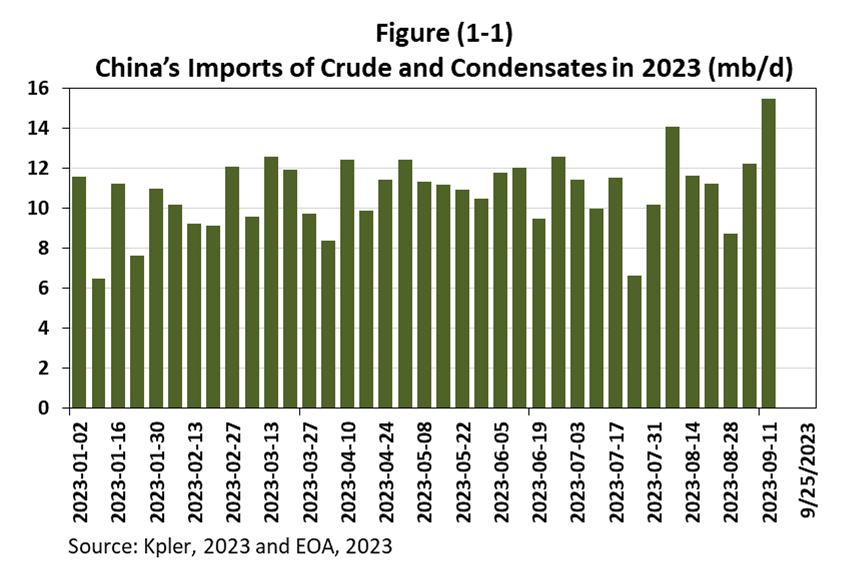

China’s oil imports are at a record high. This is very bullish. Figure (1) below shows the trend in weekly imports of crude and condensates. Figure (1-1) shows the import trend in 2023.

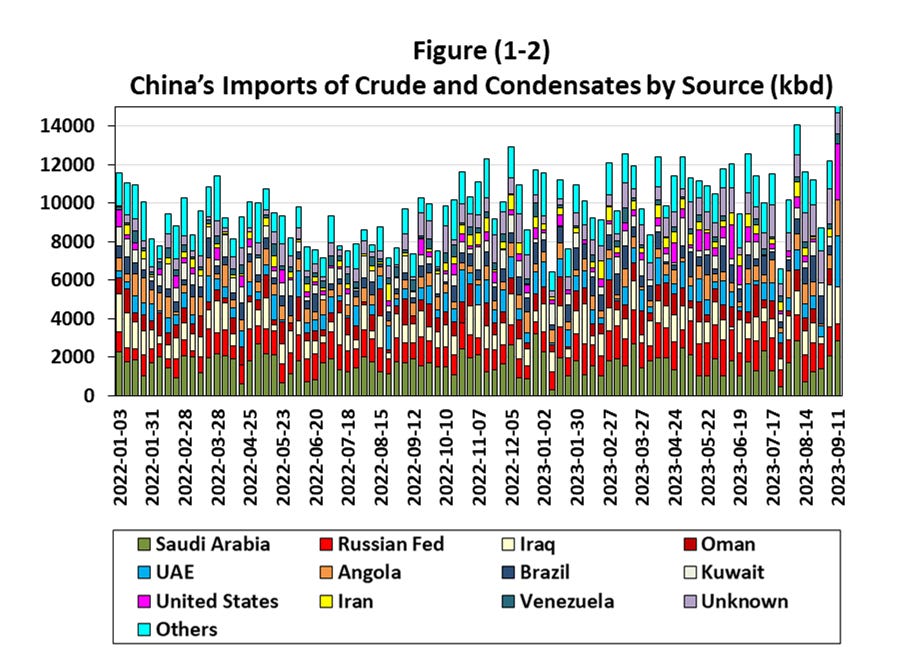

The recent increase in crude imports came with a twist: A major change in sources of imports! Imports from Russia and Iran declined, while imports from Saudi Arabia the UAE, Iraq, and the US increased as shown in Figure (1-2). Is this a trend or a blip?

2- China’s Crude Inventories

As imports increased, crude inventories started rising again as shown in Figures (2) and (2-1)! Again, is this a new trend or a blip?

Chinese companies stored oil when oil prices declined and withdrew oil from inventories when prices were high as shown in Figure (2-2) below. Inventories in teh chart include commercials and strategic inventories in above-ground storage facilities. We expect this behavior to continue. There is a lag of 2-7 weeks for inventories to be in the market as a reaction to prices.

3- China’s Oil Exports

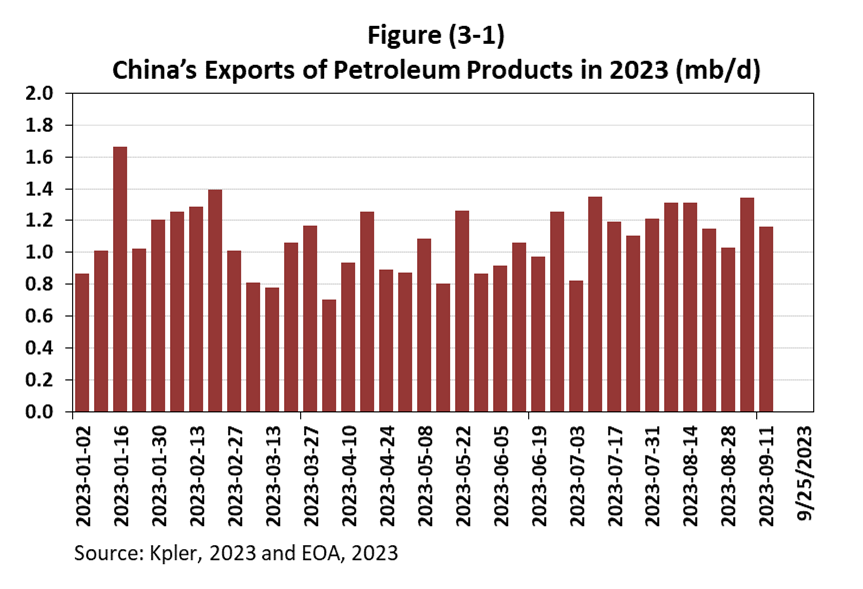

Exports of petroleum products are rising (Figures 3 and 3-1) and are expected to continue to rise as independent refineries are given higher export quotas.

4- Economic Growth and Oil Consumption

The relationship between oil consumption and GDP growth has weakened in recent years due to structural changes in the Chinese economy (larger service sector), improved efficiency, and reduced energy intensity. That means increasing economic growth in China will not lead to the same increases in oil demand that we have seen in the past.

5- Conclusions

Given the conflicting signals from the Chinese data, it is difficult to conclude that Chinese oil consumption is recovering, hence the impact of the recent increase in oil imports on global oil markets is limited, at least for now.

An increase in Chinese oil “demand” might mean an increase in inventories and exports. Since oil prices are near $94/b (Brent), we rule out the possibility of building inventories. We expect inventories to decline and exports of petroleum products to increase.

As for the recent changes in sources of imports, we believe that a continuous increase in Chinese oil consumption leads to an increase in imports from Saudi Arabia and its Gulf allies, West Africa, and the US. Russia and Iran are maxed out. But we need a few more weeks to figure out if a trend is emerging.

Finally, our view from the EOA 2023 Oil Market Outlook that we published in early January is that if the forecasts of OPEC and the IEA of growth in global oil demand are correct, OPEC has no choice but to increase oil production in the fourth quarter. EOA