Venezuelan Oil: What does it mean to suspend US sanctions?

As the US increases its imports from Venezuela, its imports from Canada will decrease (with 6 charts)

EOAs’ Main Takeaways

The impact on global oil markets is limited in short and medium terms.

US tight oil producers will benefit by regaining their diluent market share.

It will help US Gulf refiners produce more distillates.

As it increases its oil imports from Venezuela, the US will reduce its oil imports from Canada. The Trans Mountain Pipeline has become more important than ever to oil sands producers in Alberta.

The News

The Biden Administration eased sanctions on Venezuela, including oil exports, in exchange for fair and transparent presidential elections in Venezuela in 2024. A series of sanctions were imposed by President Trump between 2017 and 2021, including major sanctions in 2018 and 2019.

After an Electoral Roadmap agreement was signed by the Maduro government and the opposition represented by the Unitary Platform, the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) issued four general licenses suspending some sanctions:

A six-month general license authorizing oil and gas transactions between the U.S. and Venezuela. The renewal of this authorization is conditional on meeting certain steps: “The license will be renewed only if Venezuela meets its commitments under the electoral roadmap as well as other commitments with respect to those who are wrongfully detained,” according to a press release by the US Department of Treasury on October 18, 2023.

General license allowing deals with Venezuelan state-owned gold mining company Minerven. The Treasury said this action reduces the black market in gold trading.

An amendment to remove a secondary trade ban on some Venezuelan sovereign bonds. However, “The ban on trading in the primary Venezuelan bond market remains in place,” as stated by the press release.

An amendment to remove a secondary trade ban on Petróleos de Venezuela, S.A. (PdVSA) debt and equity.

The logic of the amendments is to reduce illegal activities while not benefiting the regime. It is clear these actions are intended to limit the amount of money that flows to the Maduro government. But as we learned from various events, what is on paper is different from reality.

The government of Maduro has until November to establish a timeline and process to reinstate all candidates. Some sanctions will be reinstated if the government doesn’t meet the deadline. As we will see later, the Biden Administration is so desperate for a deal, that it will turn a blind eye to any violations.

Impact on the Oil Market

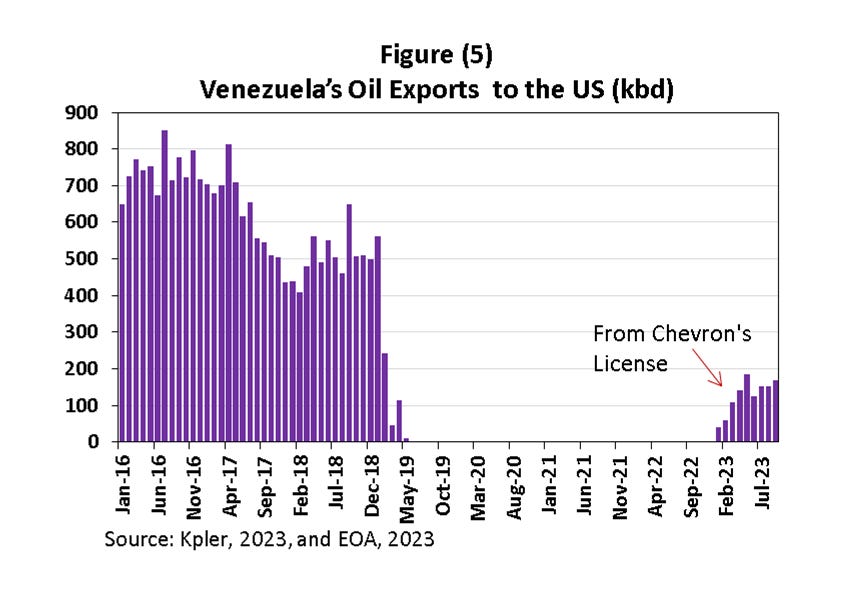

The move to relax some of the sanctions on Venezuela has been predicted since last year. It came as a result of lengthy negotiations and has nothing to do with the current events in the Middle East. Last year, the Biden Administration allowed two European companies, ENI and Repsol, to ship Venezuelan oil to Europe. Although Chevron has not left Venezuela despite the sanctions as the company kept getting exemptions from the Trump Administration and later from the Biden Administration, it received a license last November to produce and export Venezuelan oil to the US. (See Figure 2 below)

Three facts are clear:

Venezuela, the holder of the largest oil reserves in the world (see Figure 1), needs the expertise and technical abilities of international oil and service companies. It needs Chevron, SLB, and others. It also needs foreign investment.

Venezuela needs US diluent, known as natural gasoline or C5, on a steady basis, to mix with its heavy crude so it can be transported via pipelines and tankers. US tight oil producers will benefit from selling such diluents, although the amount is relatively small and may not exceed 125,000 b/d in the foreseeable future.

Some US refiners need Venezuelan crude. Those refineries were built and configured to use Venezuelan crude or similar crude qualities from other countries.

It has been our view since last year that if diluents are available, Venezuela can add 300,000 to 400,000 b/d in a matter of weeks. Then production will plateau for months until the results of new investment and the involvement of major oil service companies start showing some increases in production. However, increasing production in large quantities is a long-term proposition: a review of the history of 6 oil-producing countries that suffered from political instability and sanctions shows that adding 1 mb/d requires at least three years. For now, Chevron added 200,000 b/d and for the short run, only 100,000 to 200,000 b/d can be added, and that is it. Most of these additions will be exported.

If everything goes well, and plans and exact dates are set for elections in 2024, it is expected that the US will renew the license for another six months. This will allow oil service companies such SLB and others to increase Venezuela’s oil production by up to 400,000 b/d by the end of summer of 2024, just before the US presidential elections. Most of that amount is expected to be exported to the US (see Figure 5).

While we are skeptical about an optimal political resolution in Venezuela, we believe that the Biden Administration will turn a blind eye to elections violations and human rights abuses. Therefore, we will see an increase in oil production and exports even if the conditions set by the Biden administration are not met. In fact, the involvement of the US in the presidential elections of another country by siding with one group is enough to ruin the reputation of such a group. We have seen this in the past in Venezuela where the US propped candidates who were labeled as traitors within Venezuela.

As mentioned above, the focus of the Biden Administration on Venezuela has nothing to do with current events in the Middle East but fits with old ideas of the Democrats from President Clinton’s years: energy integration in the Americas. When President Clinton pushed for it, Venezuela opened its door to foreign investment. As a result, production increased (see Figure 3), and prices collapsed. The actions of Venezuela at that time threatened the unity of OPEC. In fact, it has been argued in certain circles that the major increase in Saudi oil production in 1997 was a reaction to Venezuelan production expansion with no regard to the OPEC quota.

The collapse of the oil market in 1998 and the election of Hugo Chavez saved the day. We do not see this being repeated if the Maduro regime stays in power. Even if the opposition wins, it is fragmented, and the human resources that PDVSA had in the 1990s no longer exist. Many were fired by Chavez in 2002-2003. A large number of experts and engineers left Venezuela to work in Colombia and the Middle East. Therefore, the increase in oil production in the medium and long term is expected to be slow and limited. The impact on the global oil market and oil prices will be also limited because of the expected increase in demand in the next few years. In other words, the increase in production in the long run is needed to help meet growing oil demand.

In addition, the rise in exports will provide the government with revenues that will stimulate the economy, as a result, domestic oil consumption will increase. That means part of the increase in production will go to domestic consumption, not to the international markets.

The Impact on Canadian Crude

Given crude quality, a strong recovery of US imports from Venezuela will come at the expense of imports from Canada. WCS/WTI differentials are expected to widen. That will not be the case when the Trans Maintain Pipeline comes online. In fact, there is an argument to be made that some US refiners in the Gulf of Mexico region are afraid that Canada’s exports through the Trans Mountain Pipeline will come at their expense: less crude and higher prices. Importing from Venezuela becomes a necessity. The end result depends on growth in Albert’s crude production on one hand, and the price differentials between the WCS price and the price of oil shipped in the Trans Mountain pipeline. The latter is a function of crude prices in Asia, which is influenced by a web of factors from sanctions on Russia to Chinese quotas, to discounted Iranian crude, to Saudi Aramco pricing, to economic growth in the region.

In Charts

Conclusions

The partial lifting of sanctions on Venezuela, the entry of oil service companies, and the need of the Biden Administration for Venezuelan crude means an increase in crude oil production, even if the conditions set by the Biden Administration are not met. The impact is limited within any time frame: the amount that can be added in the short term is limited and has no impact on the market: up to 200,000 b/d.

By the end of next summer, Venezuela can add up to 400,000 b/d. Given the increase in demand, their impact is limited but will ease the medium sour tightness, especially if exports from Kurdistan in northern Iraq remain off the market. The increase beyond that point is also limited: foreign investment will remain constrained under the Maduro regime. If the opposition wins the elections, it will be fragmented and face strong opposition.

While we believe the temporary lifting of sanctions has nothing to do with current events in the Middle East, it will have an impact on Canadian crude. A recovery of US imports from Venezuela will come at the expense of imports from Canada. The role and significance of the Trans Mountain Pipeline have become more important than ever. In short, lifting the US sanctions on Venezuela changed the economics of the pipeline. It makes it more valuable.