US Oil Production, Shale Crude Quality, and Sub-Saharan Africa’s Growing Role in Global Gas and LNG Markets

In Today’s Issue:

· US Oil Production: An Update (4 Charts)

· LNG Projects in Sub-Saharan African Countries (4 Charts, 2 maps)

Main Takeaways

Although US February crude production declined because of weather and maintenance, the EIA data show clearly that US oil production is increasing. But all additions from the tight plays have been condensates.

We will know by the end of next month if companies have been adjusting their drilling programs to produce fewer condensates by moving to areas where they can produce crude with lower API.

We cannot be bullish just because the shale plays are not increasing production. The NGLs market is one thing, and the crude market is another.

It is all about LNG in the next few years, and therefore several Sub-Saharan African countries and energy majors want to expedite projects in the region amid growing European LNG demand.

By 2026, Sub-Saharan Africa’s LNG capacity could reach 58.2 mtpa, making it a key player in the global LNG market. However, key challenges need to be overcome to reach that target.

US Oil Production: An Update

The February data which the US Energy Information Administration (EIA) published at the end of last week, carried three shocks for the oil ultra bulls and which we summarize below:

The EIA has been underestimating production in the weekly data

US oil production is increasing

The EIA revised up December and January production numbers to 34,000 b/d and 74,000 b/d respectively.

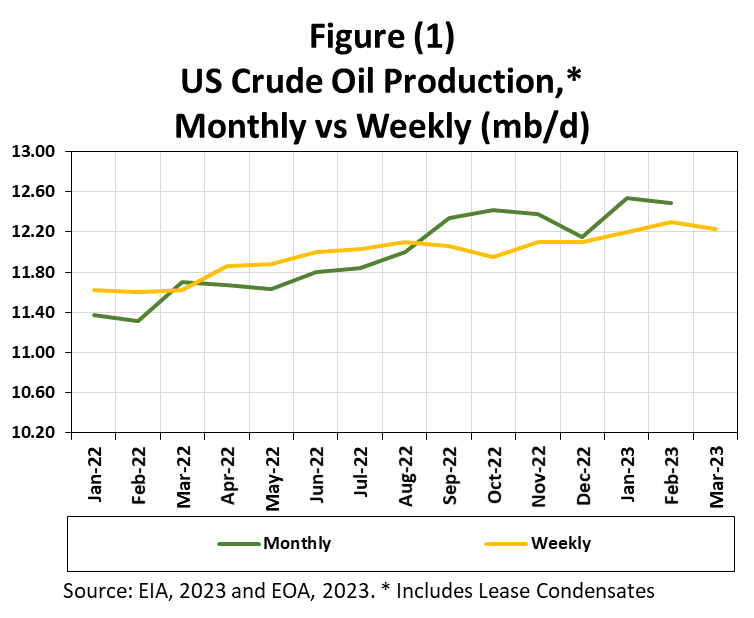

Regarding US oil production, how can we say that output is increasing when the EIA reported a DECREASE in production of 53,000 b/d in February? Well, let us look at the data below.

Figure (1) shows monthly US crude and lease condensates production versus weekly estimates. Although the weekly estimates are based on a sophisticated model the EIA uses, it has failed many times. For this reason, the monthly data, with a lag of two months, is believed to be accurate data. The figure below shows that the EIA has been underestimating production since August 2022.

Keep reading with a 7-day free trial

Subscribe to Energy Outlook Advisors' Newsletter to keep reading this post and get 7 days of free access to the full post archives.