US Coal Exports Continue to Increase While EIA Oil Data is Wrong Again!

Cheap solar panels? do not blame China!

Dear Subscribers,

We are please to share with a complementary copy of our Daily Energy Report.

Chart of the Day: US power generation by source

Summary

Figure (1) above shows a comparison of US net power generation in the years 2023 and 2013. The share of coal declined substantially, while the role of gas and renewables increased markedly. Hydro suffered because of the drought in recent years.

EOA’s Main Takeaway

Those who are celebrating the decline of coal as an environmental win and how government policies can be used to fight climate change must awaken to two realities:

While no one can deny that strict government policies forced utilities to close certain coal-fired power plants, it was the abundance of cheap gas that played the bigger role.

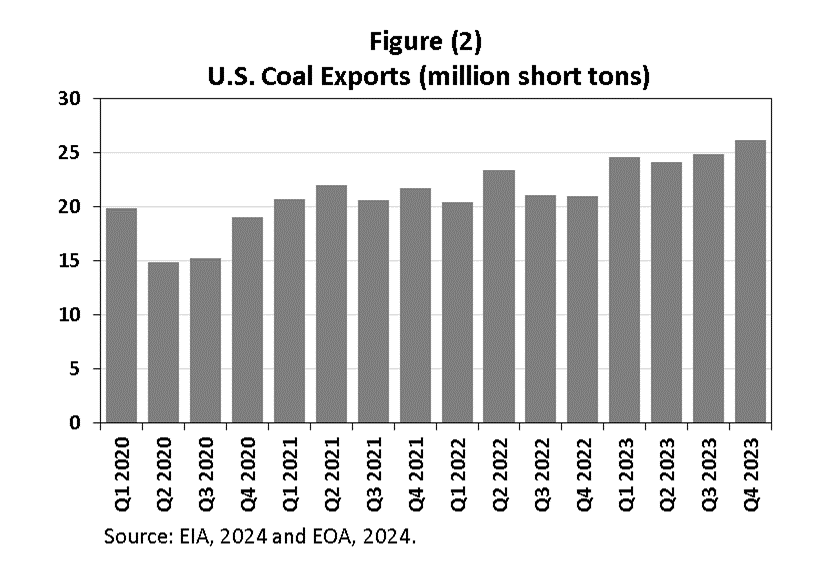

As the US reduced its use of coal in power plants, it exported coal to the rest of the world. Those who cheer the closure of US coal-fired power plants cannot reasonably invoke the fight against climate change while that coal is being burned somewhere else. Figure (2) below shows the increase in coal exports and how demand within the US declined.

However, the collapse of the Baltimore bridge halted the exports of coal from the port and US coal exports are expected to decline for a few weeks. However, coal surplus might end up suppressing natural gas prices.

Reuters: US EIA lowers coal exports forecast for April and May following Baltimore bridge collapse

Story of the Day

Argus: OPEC+ Crude Output Above Target Again

Summary

OPEC+ output surpassed its March target due to overproduction by members like Iraq and Kazakhstan, despite ongoing cuts to support the oil market. Iraq, Kazakhstan, Kuwait, and Gabon were key overproducers. While OPEC was over target, non-OPEC members were under, with Russia close to its goal despite refining capacity damages. Civil conflict in Sudan contributed to underproduction there and in South Sudan.

EOA’s Main Takeaway

We covered the increase in OPEC crude exports a few days ago. This increase in exports, and now this increase in production, answers those who claim that OPEC has been squeezing the market and those who expect prices to exceed $100/b. The market is not that tight.

Keep reading with a 7-day free trial

Subscribe to Energy Outlook Advisors' Newsletter to keep reading this post and get 7 days of free access to the full post archives.