Trump’s Enforcement of Oil Sanctions on Iran: 2025 is NOT 2019

The factors that reduced Iran's oil production and exports in 2019 do NOT exist today (with 4 charts)

This is an edited version of the note posted on December 4, 2024. Since then, the Trump Administration imposed sanctions on Iranian oil. As expected in our December 4 note, none worked.

Recently, the Trump Administration began negotiations with Iran. After several meetings, talks broke down suddenly, angering President Trump, leading him to write the text below.

President Trump sounded desperate, though the outcome was predicted. Our research, shared months ago, shows that sanctions and tanker blacklisting have little impact on Iranian oil exports. We explained why these policies fail. Trump's statement confirms this, admitting indirectly that sanctions since his second term began are ineffective.

As expected, we foresaw failure of negotiations, though not in this abrupt way. The regime cannot meet Trump's demands, nor can Trump meet the regime's.

If the Trump administration acts on his statement, it affects the US and China, not Iran and the US. This may raise oil prices temporarily, as US options for dealing with China are limited.

One unintended consequence of Trump's secondary sanctions/tariffs is that Iranian oil would be heavily discounted. China will buy cheap Iranian crude and chemicals while Americans pay higher world prices.

The Trump administration targets Iran's seaborne oil exports. Disrupted shipping will boost land shipments. Tankers will haul crude and products on dusty roads to neighboring countries. In mountains, oil and products move in barrels and containers on mules, often drone-monitored. If Trump pursues, he risks encountering Taliban in Afghanistan, ISIS and shi’a militia in Iraq, and tribal militia in Pakistan .

The Trump administration focuses on Iran's seaborne oil exports. If shipping is disrupted, land shipments will increase. Hundreds of tankers will transport crude and products on dusty roads to neighboring countries. In mountainous areas, oil and products are shipped in barrels and containers on mules, sometimes monitored by drones. If Trump wants to follow, he will end up in Afghanistan and probably another encounter with ISIS!

Below is the edited Note form December 4, 2024

Conventional wisdom suggests President Trump will enforce sanctions on Iran. Oil bulls believe this would cut Iran’s oil exports by over 1 mb/d, raising prices, citing the sharp decline in Iran’s oil production and exports in 2019 after Trump’s sanctions in 2018. However, the factors that caused the 2019 reduction no longer apply. Thus, Trump’s sanctions on Iran will likely have minimal impact on global oil markets. Enforcing oil sanctions could even be bearish for oil.

Notably, reported oil export figures since 2019 by the media and some banks have been lower than actual exports, as some dark fleet and onshore shipments were uncounted.

2025 is not 2019

On November 5, 2018, President Trump reimposed all sanctions on Iran that were lifted under the nuclear deal with the Obama Administration in 2014. To avoid an increase in oil prices, President trump asked some OPEC members to increase production to compensate for the loss of Iranian oil. He also gave a temporary exemption to 7 countries and Tiwan from the sanctions. As a result, oil prices declined.

Figure (1) shows trends in Saudi Arabia and Iran’s oil production versus oil prices in 2018 and 2019. It illustrates Saudi Arabia’s production increase in September and November 2018 and Iran’s production decline due to sanctions. Oil prices dropped significantly in November after Trump granted exemptions to Iran’s clients, with some Iranian oil reaching global markets unrecorded.

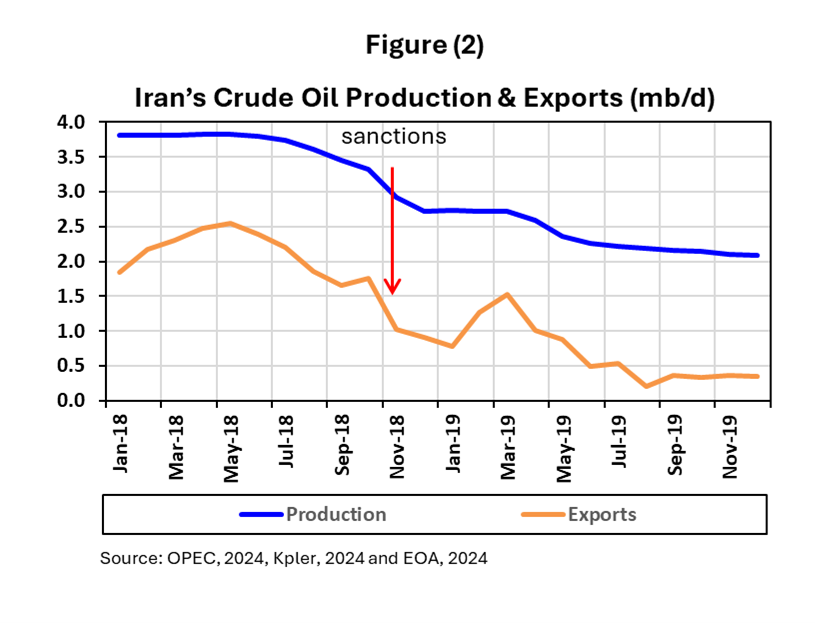

Figure (2) shows Iran's production and exports in 2018 and 2019. Although sanctions were imposed in November, production and exports decreased earlier in anticipation of the Trump Administration's plans. Figure (2) illustrates the significant decline in Iran’s production and exports post-sanctions.

Sanctions reduced Iran’s oil production and exports, as shown in Figure (2). Production fell by 1.67 mb/d from May 2018 to October 2019, per OPEC Secondary Sources. Exports dropped by 2.45 mb/d, according to Kpler, though tracking companies underestimated exports. The 2020 decline in Iran’s production and exports was due to COVID-19 lockdowns, not sanctions.

What caused the decrease in Iran’s oil production in 2019 does not exist today. Here is why:

1- Number of Buyers

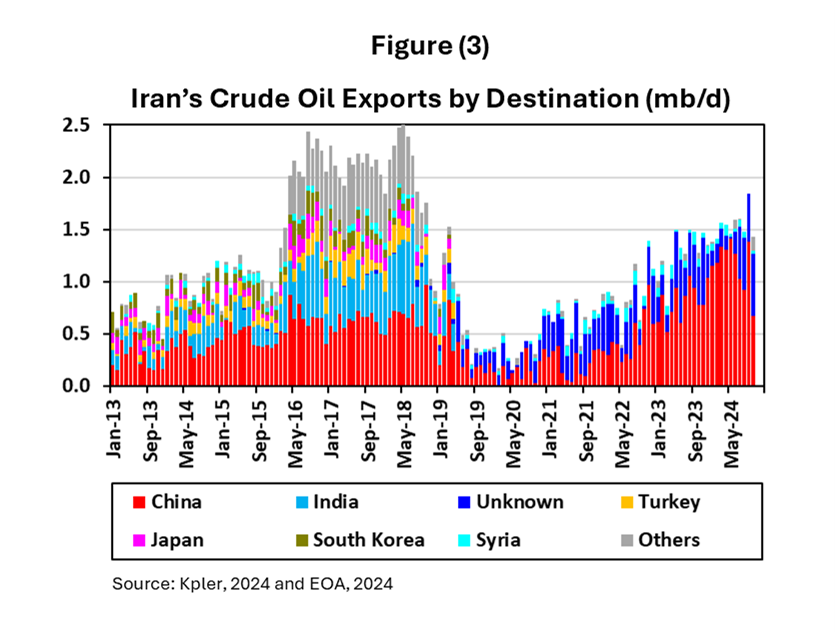

Iran exported oil to over 20 countries before sanctions. Now, it mainly exports to China. Figure (3) shows Iran’s seaborne oil exports since 2013. After sanctions were reimposed, some countries stopped importing from Iran to avoid issues with the Trump Administration. Iran halted exports to countries wanting its oil but unable to pay directly due to sanctions.

Nearly all Iranian oil now goes to China, with payments made in cash or in-kind through a non-US-controlled financial system. A small amount of oil was exported to Syria. As most Iranian oil goes to China with payments outside the international system, the Trump Administration can do little to stop it.

Chinese oil majors, listed on European and U.S. stock exchanges, operate globally and access Western capital markets. Thus, the Trump Administration has leverage to deter them from buying Iranian oil. However, China has previously prohibited these majors from directly importing Iranian and Russian oil, while encouraging independent refineries, unconnected to the U.S. or Europe, to do so. This oil is also sold to Chinese majors, often via third countries or ship-to-ship transfers.

Sanctions on specific ships or ports are ineffective. Sanctioned ships continue transporting oil when demand exists, and Iran and China adapt by shifting loading and unloading ports after they built additional ports to circumvent sanctions.

2- Payment System

Iran and China have refined their methods to bypass sanctions, using technology, fleet management, and a payment system independent of the international financial system and U.S. control. Chinese refiners pay for Iranian oil, often by depositing funds in Chinese banks, which Iran uses to purchase and import Chinese goods.

In 2019, Iranian oil production and exports fell due to some countries' reluctance to import Iranian oil to avoid issues with the Trump administration and Iran's unwillingness to sell to nations who do not pay Iran directly fearing sanction violations. These issues no longer apply, as most Iranian oil exports now go to China.

In conclusion, Iran’s exports dropped in 2019 because much of its oil trade relied on the U.S.-controlled international payment system, which is no longer the case.

More on this topic:

The axis of evasion: Behind China’s oil trade with Iran and Russia

Iran’s Petroleum Exports to China and U.S. Sanctions

3- Crude Quality

In 2018, before sanctions, Iran exported various crude types to over 20 countries. As exports shifted to China, Chinese refineries required specific crude types, forcing Iran to reduce production and exports of certain types of crude that Chinese refiners do not want.

Since then, Iran developed new fields producing crude suited for Chinese refineries. The factors causing the 2019 decline in production and exports no longer exist.

Figure (4) shows changes in Iran’s crude export quality. Iran introduced new crude blends for Chinese demand, closed older heavy crude fields, and shifted to West Karun fields near Iraq. This strategic move helps bypass sanctions while Iraq cannot benefit from these fields. Condensate exports also declined.

Oil exports now focus on lighter, medium crudes, reducing heavy grades. Lighter grades fetch higher revenues. Notably, “light” crude is medium (API ~33), and “heavy” is near medium (API ~29). Note that Iran generated higher revenues, not only because of the increase in exports, but also because of higher crude quality, which analysts overlooked.

4- Old fields

After signing the nuclear deal with the Obama Administration and increasing oil production, the National Oil Company invested in new areas and closed older, inefficient, costly fields. The closures followed sanctions, reducing production, as shown in Figure 4. Currently, no old fields remain to close. The year 2025 is not 2019!

Conclusions

In 2019, sanctions led Iran to cut oil production and exports, but those conditions that reduced production and exports do NOT exist today. With China's assistance, Iran circumvents sanctions, exporting nearly all its oil to China, beyond U.S. payment control. Crude quality now meets Chinese refiners’ needs.

The Trump administration could pressure Chinese oil majors, listed on U.S. and European stock markets and using U.S.-controlled payment systems, to halt Iranian imports. However, China has previously countered this by directing independent refiners, unconnected to Western markets, to import Iranian oil, which is then sold to the oil majors. Also, the oil majors buy Iranian oil via third countries like Malaysia (Malaysia’s Role in Laundering Iranian Oil).

We believe Trump will not reimpose sanctions on Iran without OPEC members agreeing to increase production to offset lost Iranian oil. This could be bearish for oil prices, as seen in November 2018 when sanctions caused a 29% price drop. Enforcing sanctions on Iran may not be bullish and could be bearish if OPEC boosts output under Trump’s pressure. EOA