The Role Of China in Lowering Global Oil Prices

Is China's oil demand growing? (With 6 Charts)

Summary

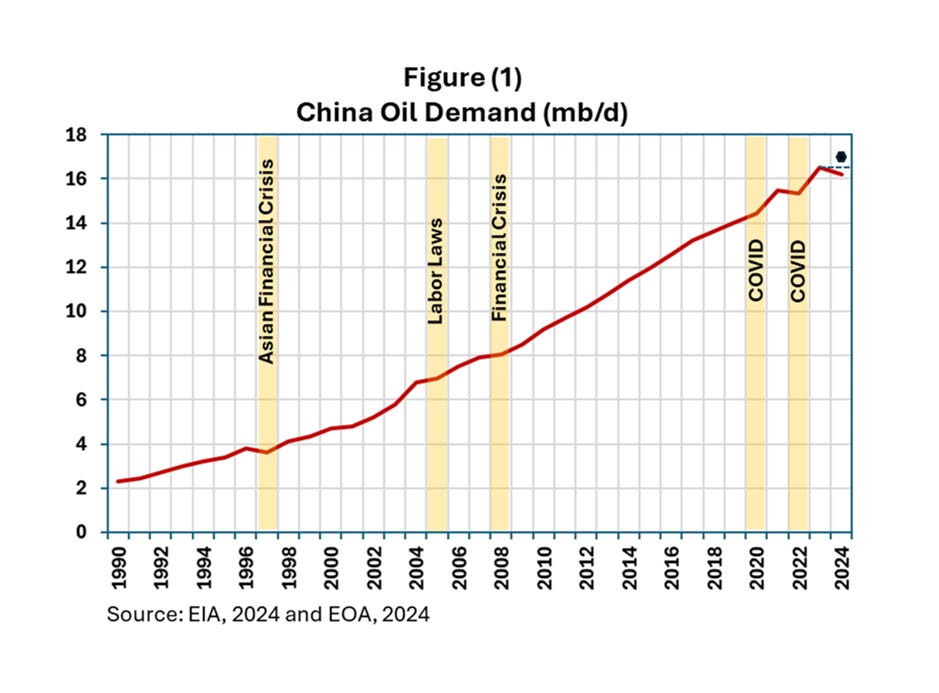

Figure (1) shows trends in China oil demand since 1990 on a yearly basis. It shows that historically China’s oil demand declined only twice, and in both cases the decline was predicted: during the Asian financial crisis in 1997 and during the COVID lockdown in 2022.

Growth in oil demand stalled in 2005 and 2008. Implementation of labor laws in 2005 shutdown private generation at thousands of factories that depended heavily on diesel and fuel oil to operate because of power shortages. The oil price spike in 2008 halted the growth in oil demand, although one could argue that it was both the price spike and the financial crisis.

The question is: What is going on in 2024? Major organizations such as the IEA and OPEC still see growth in oil demand, but evidence from the sector show that oil demand growth is lower than their expectations and might have already declined relative to that of last year, making the decline in 2024 the first of its kind: It is domestic this time!

What is the reality of this decline in Chinese oil demand?

Was this decline in oil demand caused by penetration of electric vehicles and LNG trucks?

The answers will surprise many analysts, traders and investors. All of these issues are discussed below.

Forecasts of Growth Were Too High

This year, 2024, could be the only year of decline in oil demand in China’s recent history that is related to structural problems within China’s economy and has nothing to do with an international financial crisis or a massive increase in oil prices. While the IEA still see a growth of 150 kbd in 2024, OPEC remains optimistic with a growth of 580 kbd. However, others see negative growth, especially for certain petroleum products.

Keep reading with a 7-day free trial

Subscribe to Energy Outlook Advisors' Newsletter to keep reading this post and get 7 days of free access to the full post archives.