The Rise in Global Gasoline Consumption, and the Impact of LNG Plants Maintenance on Natural Gas Prices

In Today’s Issue:

Global Gasoline Consumption is Rising: Bullish (15 Charts and 1 Data Table)

The Impact of LNG Plants Maintenance on Global Gas Balances: Bullish (6 Charts)

MAIN TAKEAWAYS

Gasoline consumption increased in major EU economies in February. Despite labor strikes, gasoline consumption in France in January and February was higher compared to the same period last year.

Gasoline consumption in non-EU members, Norway and the UK, also increased in February WoW and YoY.

Despite the surge in electric vehicle sales in Norway in recent years, motor fuel consumption has not decreased proportionally. In fact, there should have been a fourfold drop in the actual decline in fuel consumption. This raises questions about the rate of gasoline and diesel displacement, and whether the future decline in oil demand is being exaggerated.

US gasoline consumption also increased in February MoM and YoY, and it was the highest since February 2016.

Canada’s gasoline consumption declined drastically in the first two months of the year. It reached a level in February that has not been seen in more than two decades.

Gasoline consumption has been increasing in emerging economies with high urbanization rates: India, Indonesia, and the Philippines.

Maintenance activities at several LNG facilities are expected to drive down LNG exports amid growing LNG demand from Europe, and early signals of demand recovery in Asia.

The most significant maintenance work that could affect global supply will be conducted at Russia’s 10.8 mtpa Sakhalin-2 LNG plant next summer.

Global Gasoline Consumption

The data we share in this section is bullish for oil demand since it shows clear signs of recovery in unexpected regions. We start off with a summary of our findings before we take a deep dive into the data we have collected from various reputable organizations, in addition to official figures.

SUMMARY

Data from 50 countries, including the OECD, China, India, and other emerging economies indicate that gasoline demand increased to a record high in February 2023, despite the surge in electric vehicle sales in recent years. This is bullish given that fears of the banking crisis, recession, and the high US dollar have gripped the market for a while now.

Figure (1) below shows trends in gasoline demand in the selected 50 countries, based on data from JODI, the International Energy Forum (IEF), and estimates calculated by the EOA for the missing February data of 10 countries. Since the IEF sample covers only 40 countries, we estimated the demand of 10 others in February to get a sample of 50—and our results were in line with those of the IEF. It is also worth noting that the numbers in Figure (1) are the average for the 50 countries, or the net increases and decreases.

Figure (1) shows that gasoline demand is at a record high for this time of the year. The recovery has been registered in China, the US, the UK, Germany, Spain, the Netherlands, and France. But the increases have so far originated from countries like India, Indonesia, and the Philippines.

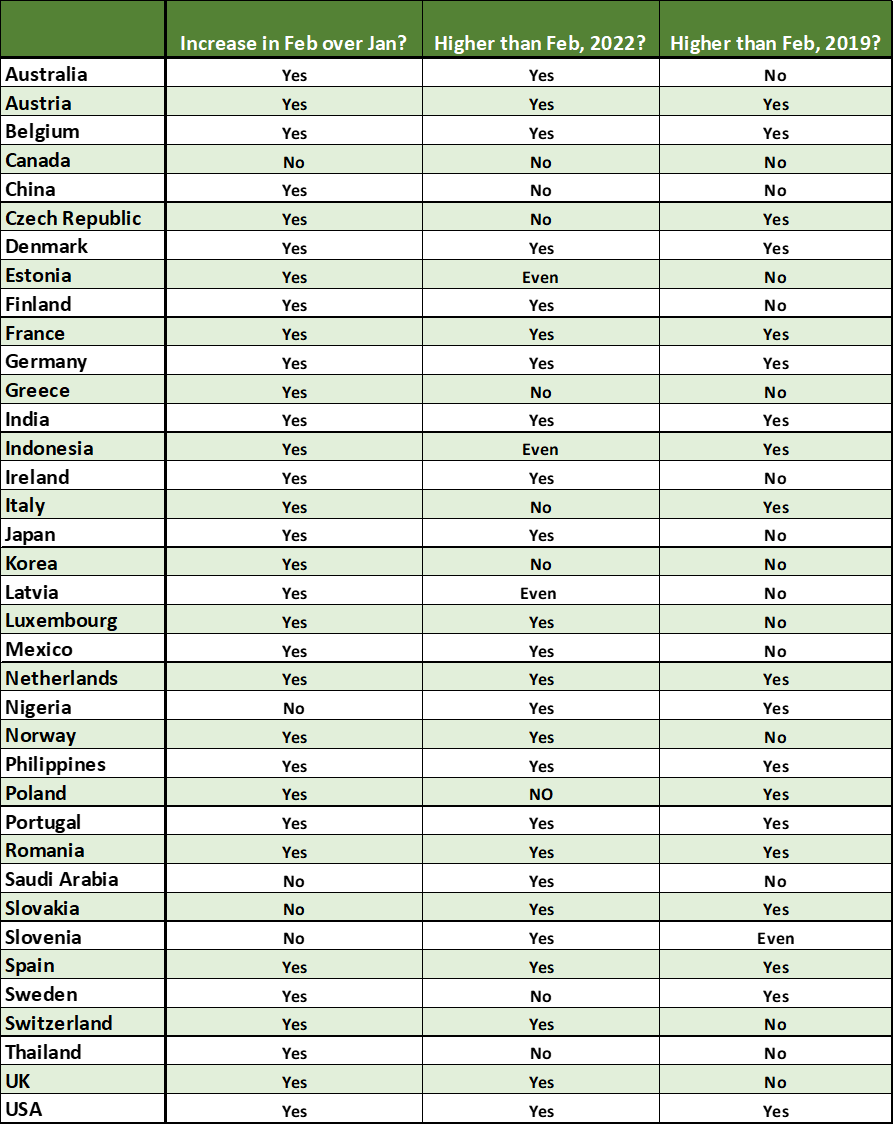

After analyzing the data, we came up with some questions to understand three trends in major consuming countries:

Did gasoline demand in February 2023 exceed the levels of January 2023?

Was gasoline demand in February 2023 higher than that of February 2022?

Was gasoline demand in February 2023 higher than that of February 2019 (pre-COVID)?

Table (1) below presents the answers for the countries with complete data sets. Other countries that are not mentioned do not have so far updated figures.

As we examined the data, we found a few surprises:

Despite of the massive increase in electric vehicle sales in Norway, gasoline consumption increased in February MoM and YoY.

While US gasoline demand in early 2023 increased, it declined markedly in Canada. In fact, gasoline demand in Canada in early 2023 was the lowest in more than two decades.

The increase in gasoline demand in major European economies has been significant, especially in Germany. Demand for gasoline in France in January and February 2023 remained higher than in the same period in 2022 despite labor strikes and refinery shutdowns in the country since the beginning of this year.

Gasoline demand in oil-producing countries has yet to return to pre-COVID levels.

Table (1)

Source: JODI, IECF, 2023 and EOA, 2023

IN DETAIL

Keep reading with a 7-day free trial

Subscribe to Energy Outlook Advisors' Newsletter to keep reading this post and get 7 days of free access to the full post archives.