The Impact of the Closure of Keystone Could Be Larger than Expectations

Lower Inventories, Wider Differentials, and Crude Quality Issues

December 9, 2022

Main Takeaways

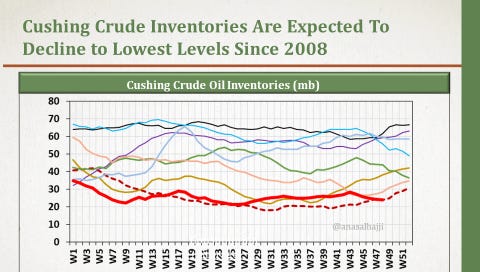

The shutdown is expected to lower inventories at Cushing, Oklahoma, increase crude via rail from Canada, support WTI & Latin American crudes, and widen price differentials between WTI and Canadian crude.

The impact of the shutdown on crude price differentials is larger than the impact on the overall crude prices

The impact of the shutdown on crude quality is more important than quantity. Venezuelan crude oil additions will become more important than ever.

If the closure of the Keystone crude oil pipeline lasts more than a few days, the Biden Administration may order another emergency release from the Strategic Petroleum Reserve (SPR).

IN DETAIL

Keep reading with a 7-day free trial

Subscribe to Energy Outlook Advisors' Newsletter to keep reading this post and get 7 days of free access to the full post archives.