Guest Post by Velina Tchakarova (Originally written for our sister publication www.attaqa.net)

In an unexpected financial uptick, Russia’s oil and gas revenues witnessed a staggering increase of 79.1% in the first quarter of 2024, reaching 2.9 trillion rubles. This financial achievement marks a significant milestone when compared to the same period in the preceding year. The Ministry of Finance, through its press service, confirmed these preliminary figures on Monday, shedding light on a robust economic performance that underscores the nation's thriving energy sector.

The press release elaborated that the oil and gas revenues amounted to precisely 2,928 billion rubles, attributing this remarkable growth to a confluence of factors. Primarily, the surge in revenues is linked to the surging prices of Russian oil on the global market. Additionally, a notable one-time receipt was recorded in February, emanating from an additional payment for the mineral extraction tax on oil for Q4 of 2023. This was in direct correlation with recent legislative amendments aimed at adjusting the excise duty reimbursement on petroleum raw materials. The Ministry further highlighted that the influx of oil and gas revenues has not only surpassed the baseline expectations but is also projected to maintain an upward trajectory in the ensuing months. This optimistic forecast aligns with the current global energy dynamics and Russia's strategic positioning within the market.

Beyond the oil and gas sector, the Russian federal budget also reported a robust increase in non-oil and gas revenues, which escalated by 43.2% to reach 5.8 trillion rubles. This achievement (+43.2%) is hard to believe, but it is partly explained by data from the Ministry of Economic Development, according to which in February Russian GDP increased by 7.7% in annual terms. If this is true, non-oil and gas revenues are rising in proportion to economic growth. This uplift was significantly influenced by a 23.9% rise in turnover taxes revenue, including VAT, alongside one-time planned non-tax revenues. The Ministry of Finance attributed this comprehensive revenue growth to the country's dynamic fiscal management and the strategic exploitation of favorable global market conditions. Specifically, the surge in Brent oil prices, which exceeded $91 per barrel on ICE for the first time since last fall, plays a pivotal role in bolstering the nation's financial outlook.

Russia's Federal Budget Revenues Soar in Q1 2024, Marking a Significant Economic Uplift

Russia's financial landscape has showcased remarkable strength in the first quarter of 2024, with the federal budget revenues amounting to 8,719 billion rubles, a significant 53.5% increase compared to the corresponding period in 2023. This substantial growth underscores a robust economic momentum, buoyed by both oil and gas and non-oil and gas sectors, setting a solid foundation for future fiscal stability and growth.

The Ministry of Finance's recent announcements reveal a comprehensive financial upturn across the board. Notably, the non-oil and gas revenues of the federal budget experienced a substantial boost, totaling 5,791 billion rubles and marking a 43.2% increase year-on-year. This impressive growth is largely attributed to the increased revenues from turnover taxes, including VAT, which surged by 23.9% compared to the previous year, with a notable 35.1% increase recorded in March alone. Such figures not only surpassed the planned levels but also signal a stable base for the rapid escalation of revenues moving forward. This uptrend is a testament to the burgeoning prosperity of Russian businesses, whose increasing turnovers have led to a higher influx of taxes into the state coffers. The Ministry of Finance recognizes this growth as a reflection of the dynamic commercial activities within the country, signaling economic vibrancy.

The upward trajectory in non-oil and gas tax receipts, particularly from the largest sources of such revenues, signifies an achievement far beyond the initial expectations set by the budget law (No. 540-FZ of November 27, 2023). This performance indicates a significant positive deviation from the projections laid out during the budget's formulation, highlighting the efficiency of Russia's fiscal policies and economic resilience. On the oil and gas front, the revenues did not lag behind, amassing to 2,928 billion rubles. This represents an impressive 79.1% increase year-on-year, primarily fueled by the climbing prices of Russian oil in the global market. Additionally, a notable one-time receipt in February, attributed to an additional payment for the mineral extraction tax on oil for the fourth quarter of 2023, further bolstered these figures. This was a direct result of legislative amendments regarding the reimbursement of excise taxes on petroleum raw materials. The revenue from oil and gas has not only exceeded the baseline figures but is also expected to continue surpassing these levels, in line with the socio-economic development forecasts. This is attributed not only to the sustained high prices of Brent crude but also to a reduction in the discount of Urals crude compared to Brent from the same quarter in the previous year. The concerted efforts of Russia and OPEC+ have been instrumental in maintaining these elevated global oil prices, despite the discontent expressed by the United States and the European Union.

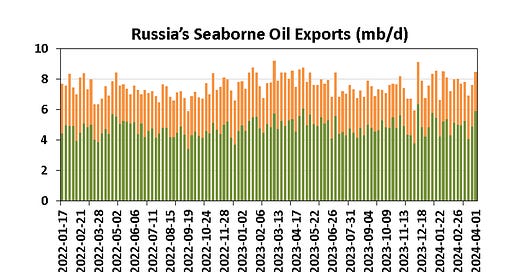

Strategic Financial Management Shields Russian Budget Amidst Oil and Gas Revenue Fluctuations

The initial quarter of the last year marked a challenging period for Russia's oil sector due to the imposition of an embargo by European nations on Russian oil and petroleum products. This led to a search for new markets, the formation of an alternative shipping fleet, and the establishment of new logistical pathways. Despite these hurdles, the year witnessed a significant turnaround; new logistical systems were put in place, and Russian oil secured two large and consistent buyers in India and China. The discount on Russian oil, though still present due to ongoing sanctions, has been nearly halved, resulting in a fortuitous boost to Russia's budget revenues and demonstrating the nation's resilience and adaptability in navigating the global energy markets.

Russia's strategic approach to managing its oil and gas revenue has notably enhanced the resilience of its budget system against the volatility of global energy markets. The deliberate accumulation of additional oil and gas revenues during periods of favorable market conditions, coupled with the judicious utilization of the National Welfare Fund (NWF) to offset potential revenue shortfalls, exemplifies a prudent fiscal strategy. This approach, governed by the "budget rule," is pivotal in maintaining the stability of the nation's budget system amidst fluctuating oil and gas income streams.

Preliminary estimates reveal that the Russian federal budget's expenditures for the first quarter of 2024 ascended to 9,326 billion rubles, marking a 20.1% increase from the previous year. This uptick in spending, particularly observed in the accelerated financial outlays during February and March, can be attributed to the efficient execution of contracts and the advance financing for certain budgeted expenses. For the fiscal year 2024, the federal budget's expenditure framework is meticulously crafted based on the upper limit of budget allocations sanctioned by the budget law (No. 540-FZ of November 27, 2023). Additionally, the allocation incorporates the volume of additional non-oil and gas revenues, adhering to the stipulations of the "budget rule." This rule acts as a financial safeguard, enabling the government to navigate the unpredictability of oil and gas revenues without compromising on its expenditure commitments. Despite the heightened expenditure, the federal budget's deficit was significantly contained at -607 billion rubles at the quarter's end. This figure is remarkably lower by almost +1.5 trillion rubles compared to the deficit level recorded in the same quarter of the previous year. This fiscal achievement is indicative of a strong and disciplined budgetary management system, efficiently balancing between revenue generation and expenditure obligations. Moreover, the broader budgetary framework, encompassing the budgets of the entire budget system, concluded the first quarter with a surplus. This positive financial outcome further demonstrates the efficacy of Russia's fiscal policies and its adept management of both oil and gas and non-oil and gas revenues. The strategic use of the NWF and adherence to the "budget rule" are instrumental in safeguarding the nation's economic stability, providing a solid foundation for sustainable fiscal health and economic growth.

So What?

In 2023, the landscape of Russian oil and gas exports was fraught with challenges as the country navigated through a barrage of intensified sanctions. The West took a firm stance, with measures that included the implementation of an embargo on the maritime transport of petroleum products, building upon a prior embargo on crude oil shipments enacted in December 2022. These sanctions extended to ancillary services such as insurance, brokerage, and the financing of oil trades exceeding the price cap of $60 per barrel. Furthermore, the European Union, in its June sanction package, specifically targeted the logistics of oil transport by prohibiting the entry of tankers involved in the transhipment of oil from other vessels into EU ports. These cumulative restrictions precipitated a steep decline in the export of Russian energy resources to Europe, a contraction far more pronounced when compared to the levels of 2022. Concurrently, a decelerating Chinese economy dampened the demand further, exacerbating the situation for Russian exports. The first half of 2023 marked a dramatic downturn in global oil exports, which more than halved from $120 billion in the first half of 2022 to a mere $77 billion. Consequently, this decline eroded Russia's commodity revenues and contributed to the trade balance's deterioration—a factor instrumental in the ruble's depreciation last summer.

Despite these setbacks, the latest data from the Ministry of Finance indicates a reversal of these adverse trends in the current year. A resurgent vigor in Russia's fiscal dynamics suggests a notable recovery, potentially signalling the country's adaptability and strategic pivot in the face of global economic adversities. As Russia continues to navigate through a complex global energy landscape, these financial achievements reflect the resilience and adaptability of its economy. The marked increase in both oil and gas, and non-oil and gas revenues, underscores a period of economic vitality, setting a positive precedent for the fiscal health of the nation in 2024.

Hydrocarbon sales have not only met but exceeded the projections of the department, but there is a well-founded anticipation that this upward trend in oil and gas revenues will continue to surpass budgetary expectations in the months ahead. This fiscal boost is largely attributable to the robust global prices of Brent oil, coupled with a significant narrowing of the Urals discount relative to Brent, especially when compared to the first quarter of the previous year. The strategic management of global oil prices has been pivotal, and Russia, in concert with OPEC+, has adeptly navigated this arena, sustaining high prices despite the challenges posed by the dissatisfaction from key international players like the United States and the European Union. In the U.S., the direct impact of soaring oil prices is acutely felt at the gasoline pump, stirring public discontent with the Biden administration—an outcome that carries political ramifications in an election year. The EU, heavily reliant on imported hydrocarbons due to its own limited production, is also bearing the brunt of these elevated prices.

For Russia, the fiscal significance of the price elevation for its Urals crude cannot be overstated. This is particularly impactful considering the substantial shrinkage in the discount to Brent—from a substantial $31 per barrel last year to a considerably lesser average of $17 per barrel this year, resulting in an average selling price of Urals oil at $67 per barrel. Despite these sanctions and initial setbacks, Russia has successfully reengineered its logistical framework and secured steadfast buyers in India and China. The maintained discount on Russian oil, though lessened by nearly half, continues to offer a competitive edge in these markets.

In an effort to insulate the economy and stabilize the ruble's exchange rate from the potential disruptions of surplus income, the Ministry of Finance is strategically expanding its asset portfolio. With a decisive policy action, the Ministry has resolved to intensify its acquisition of foreign currency and gold, effectively doubling the purchase volume within the established parameters of the budget rule—this amounts to a significant daily investment of 11.2 billion. This proactive measure, spanning from April 5 to May 7, is part of a broader economic strategy to moderate revenue influx and its macroeconomic implications. Previously, during March and the onset of April, the Central Bank engaged in a counterbalancing tactic, executing asset sales to mitigate any potential adverse effects that might arise from the excess liquidity. These deliberate financial manoeuvres are emblematic of Russia's broader fiscal strategy, which is designed to diminish the federal treasury deficit while concurrently augmenting the National Welfare Fund. Such measures underscore the country's commitment to maintaining economic stability and ensuring a prudent management of its fiscal resources.