Reasons abound for lackluster U.S. upstream performance

As some of you know, I have been the Middle East Contributing Editor for World Oil Magazine for the last 25 years. I am reposting this article written by my colleague and friend Kurt Abraham, who is the Editor-in-Chief of World Oil. It is reposted with permission from World Oil. Copyrights are reserved for World Oil.

Here is the link to the original publication.

Reasons abound for lackluster U.S. upstream performance

Kurt Abraham, Editor-in-Chief, World Oil July 07, 2023

If you find yourself shaking your head at the sluggish performance of the U.S. upstream sector in the first half of 2023, rest assured, you’re not alone. From operators to drilling contractors to equipment/service companies, there is widespread disappointment with the current pace of U.S. E&P activity, but hardly any surprise. Most industry participants have seen it coming.

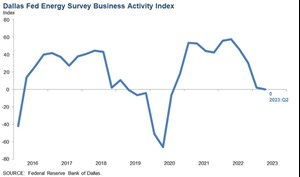

Indeed, today, July 7, that venerable indicator of upstream activity, the Baker Hughes Rotary Rig Count, stands at 680 across the U.S. While that represents a gain of six rigs from the week prior, it is still 72 units lower, or a drop of 9.6%, from the same week in 2022. It also is only the first gain in the rig count during the last 10 weeks. To put it bluntly, U.S. activity is far removed from the expectations that many industry professionals had at the beginning of this year, Fig. 1.

Fig. 1. As this chart from the Dallas Fed’s second-quarter Energy Survey indicates, it has not been a great year for U.S. upstream activity. Chart: Dallas Federal Reserve.

The major factors involved

It turns out that the industry got to this point, not because of one or two overriding factors, but due to a variety of issues. This is confirmed by results from the second-quarter 2023 Energy Survey conducted by our friends at the Federal Reserve Bank of Dallas. And while the numbers they have compiled certainly illustrate some of these facets of the problem, the real proof is in the “Comments” section of the survey. These are comments collected by the Dallas Fed from both operators and equipment/service firms. This editor has looked through these comments, and they are very enlightening, not only in the facts that they support but also in terms of illustrating the thinking of many of the industry’s top management.

From these many comments, the following items can be said to factor into languishing U.S. activity:

Commodity pricing continues to be soft

Thanks to inflation, expenses for everything have increased dramatically

Labor availability remains a thorny problem

Some operators still have expectations of a recession and are refraining from capital expenditures

A number of publicly held operators continue to exercise “fiscal discipline,” choosing to restrict capex in favor of greater dividends to shareholders

A lack of bank lending to independent producers, particularly smaller firms, is reducing their ability to invest in new drilling

The insidious quality of governmental regulation and rulemaking, along with a hostile White House, is impeding upstream activity in many ways.

When one looks at this list and ponders how the various factors interact with each other, it’s not hard to see why U.S. E&P work is struggling.

Commodity Pricing

With respect to the first point, commodity pricing, the level of oil futures prices since the third week of April has failed to break $80/bbl. During the same period, they have dipped below $70/bbl a number of times. This is hardly a price level that will stimulate a wide swath of operators to break their fiscal discipline and invest in greater capex.

Meanwhile, monthly average Henry Hub natural gas spot prices have fallen consistently since the beginning of 2023. More specifically, the January 2023 price average was $3.30/MMbtu, but it was a paltry $2.18/MMbtu during June 2023. This condition has been brought about by high gas production rates in tandem with high gas storage levels. It is exacerbated further by temperatures in the Lower 48 states that were warmer than historical averages from January through March 2023. Suffice to say, this has been a great disincentive in getting producers to drill for gas.

“Expenses for everything have increased dramatically, while oil prices remain weak and the natural gas price (net to my revenue checks) is negative,” said one producer in his comments to the Dallas Fed. “It seems as if the break-even price for oil is in the mid-$70-per-barrel range at this point. I would drill, if costs were not so high. Margins have been squeezed to the point that it is hard to commit to new projects…”

Inflated Costs for Everything

As the previous comment indicated, the economic inflation that took root in the U.S. during 2022, and which has only partially abated now is responsible for pushing up the costs for all manner of oil field equipment and services. “…operating costs have continued to increase and stay at elevated levels, which has led to a continued narrowing of profitability,” complained one operator. “Significant oilfield-services capital discipline is leading to higher costs,” remarked another producer. “Capital costs need to drop by more than 10% for increased activity [to occur].”

Meanwhile, one service-supply firm lamented that “while price increases on equipment are slowing, the continuing hiking of interest rates is forcing us to increase our prices to production companies. Meanwhile, the federal government is showing no signs of reducing spending to ease inflationary pressures. This is a significant burden that is being forced on businesses and ultimately taxpayers.”

Labor Availability

Manpower issues are a factor that just isn’t going away. From attracting fresh engineering graduates out of college to gaining new hands in the field, labor availability is impacting operators’ ability to expand activity. “Labor availability is a big issue in blue-collar areas,” observed one producer. “It is hard to find employees, and wage rate requirements continue to increase.” Another operator concurred, stating, “Labor is hard to find. Dirty-fossil-fuels stigma drives younger talent away.”

Recession Concerns

Like much of the country, producers have been waiting for a recession to occur on the back end of inflation, as so many economists had predicted/promised. And the fact that a recession still hasn’t happened is, in itself, a problem. “All of the uncertain economic projections give no confidence as to what is going to happen going forward,” said one operator to the Dallas Fed. Yet another producer commented, “It seems like the rumor of a recession is causing people to play it conservatively because they just don’t know what will happen (instead of placing a bet on growth). That uncertainty causes buyers to reduce their purchases and expectations for growth—just hold the course for now.”

On the service/supply side of things, one company said, “we are thinking the next quarter will see steady oil prices while the U.S. weathers its current inflation and/or economic struggles.”

Fiscal Discipline

Operators have expressed a variety of reasons for holding the line on spending. For instance, one firm’s respondent said, “The lower oil and gas prices significantly affect free cash flow and decrease capital expenditures.” Another producer indicated that publicly held companies are helping to trim down rig activity by distributing more profits to shareholders: “Drilling on profits after paying off debt to investors is dropping the rig count.” In addition, “things are not good in the oil and gas business for the small independent producer,” said one operator, in explaining why his firm was holding the line on capex.

Unhelpful Financial Community Attitudes

It’s no secret that a certain portion of the U.S. financial community is now turning up its nose at the idea of lending money to upstream companies, thinking that they’re helping to save the planet. “The lack of bank lending to independent producers has drastically reduced our ability to invest in new projects,” noted one operator. “We are limited to our organic cash flow, and decreased natural gas prices have lowered that cash flow by more than half.”

Meanwhile, an equipment/service firm explained the lack of activity growth with a succinct comment: “Access to capital for our client base remains a challenge.”

Governmental Interference and Uncertainty

Perhaps no factor other than commodity prices and inflated costs engendered as many comments to the Dallas Fed’s survey as did government’s role in the upstream. “Regulatory uncertainty remains an issue,” said one producer. Following on that comment, another firm stated, “The lack of support from the [Biden] administration makes investment questionable.” Still, another observed that “as the government continues its ‘war’ on oil and gas, there are related added costs to the working interest owners. We do have hope that as production struggles, the rule of supply and demand will kick in.” On the ESG front, an operator stated that “Uncertainty regarding methane venting regulations is an issue affecting our business.”

In the service/supply group, one firm vented its frustration, noting that “federal regulatory agencies continue to harass our industry, thereby jeopardizing the energy security of our country.” Preferring to take a lower profile, another company said, “We will rock along and try to stay under the radar, so as not to draw attention from lawmakers and regulators.”

This editor has a nomination for the most creative, most encompassing comment to the Dallas Fed. It comes from an operator, whose executive said, “It just feels like everyone is waiting on this recession to come—like Jennifer Love Hewitt screaming, ‘What are you waiting for?’ in the movie, I Know What You Did Last Summer. Oil prices seem to be trading like a financial instrument terrified of this pending recession instead of paying attention to supply-and-demand fundamentals, which are pointing to pretty strong draws headed our way.”

Well said! The full second-quarter Energy Survey by the Dallas Fed will be published in the July issue of World Oil.