Our team is out of the office spending the Thanksgiving Holidays with their families. We did not intend to send any reports during these days, but the news does not stop and some of it, like the ones today, are significant.

Oil prices tanked by more than 4% today on the following news:

1- OPEC delayed its meeting until November 30. It was scheduled for November 26. Some analysts believe disagreement among OPEC+ members caused the delay. Several issues need time to be ironed out. In our view, the issues could be more serious than current expectation.

2- Israel and Hamas have reached a deal on a cease-fire and hostages. This means lower political risk.

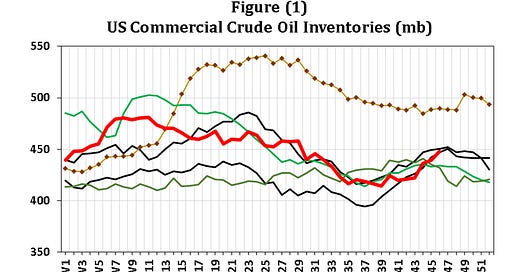

3- A whopping increase in crud inventories that exceeded all expectation. The EIA reported a crude build of 8.7 mb to 448.1 mb. While the increase followed historical trends as shown in Figure (1), it is clear that US oil demand is weaker than earlier expectations.

- Side note: the EIA continued to claim that it made the necessary changes to count for the “missing barrels.” But last week’s adjustment of 7mb shows that the problem remains.

- Additional posts on the OPEC+ meeting delay, possible causes, and impact are coming soon.