Oil Market Outlook: What Have We Learned from H1 2024?

Growth in global oil demand is lower than that of OPEC and higher than that of the IEA (with 12 charts)

We are already in the second half of 2024 and various groups and analysts have different views on global oil demand growth this year. In its monthly oil report, OPEC said that global oil demand will grow by 2.2 mb/d, while the Paris-based International Energy Agency (IEA) said that growth will be less than 1 mb/d. Banks and consulting houses are in between the two. But the difference between the OPEC and IEA forecasts is significant!

Historically, projections for global oil demand growth diverged at the beginning of each year and converged towards the end. However, this has not been the case since the end of the COVID-19 pandemic. For instance, at the end of 2023, OPEC estimated 2023 global oil demand growth to be 2.5 mb/d, while the IEA saw it at 2.1 mb/d. Even forecasts for Q1 2024 greatly varied, with OPEC estimating demand growth at 2.3 mb/d, while the IEA estimated it at 0.8 mb/d.

The objective of today’s Note is not to explain why forecasts differ or converge, but rather to utilize some tools to judge such projections. To that end, we will use oil trade and inventory data from H1 2024 to evaluate the bullishness of OPEC, and the bearishness of the IEA. The results have significant implications for traders, investors, companies, financial institutions, policy makers, and OPEC+.

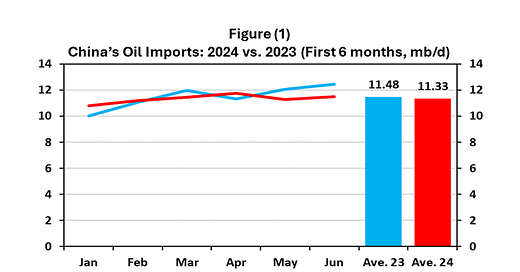

China

Keep reading with a 7-day free trial

Subscribe to Energy Outlook Advisors' Newsletter to keep reading this post and get 7 days of free access to the full post archives.