Nigeria’s LNG Exports Dip amid Growing Local Gas Demand, Output Decline

Pipeline projects through Algeria or Morocco carry significant challenges while there is a business case for LNG export projects in Nigeria (with three charts & map)

In 2022, Nigeria’s marketed gas production reached 40.4 billion cubic meters (bcm), making it the third-largest African producer, behind Algeria and Egypt, according to the Energy Institute’s Statistical Review of World Energy. Although the OPEC member is historically one of the largest LNG exporters, its exports sharply dropped in the past few years, reaching a new record low in 2023. In this article, we highlight the challenges and potentials of the gas sector in Nigeria, and the outlook for its planned pipelines and LNG projects in the short- and medium-term.

Nigeria’s Gas Production and Consumption

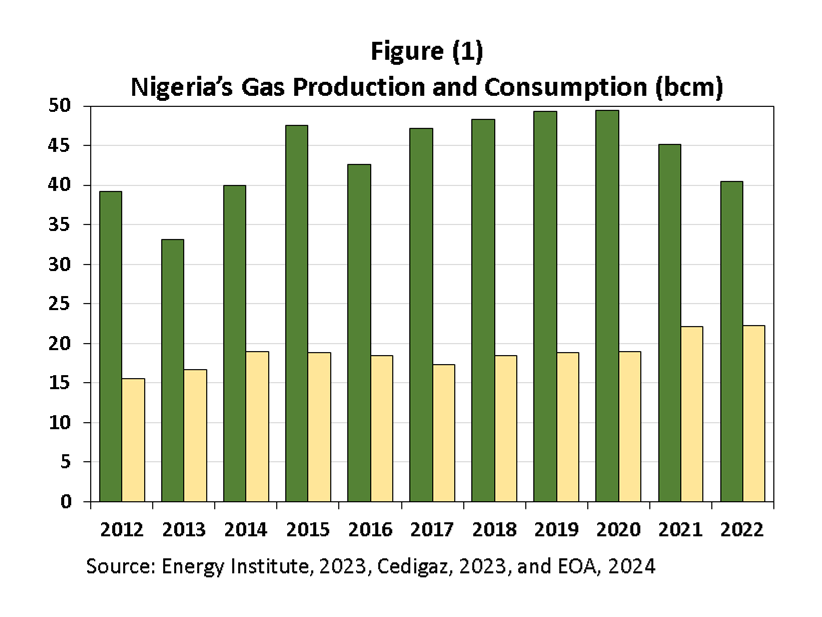

Despite holding the largest proven gas reserves in Africa, estimated at 5.9 trillion cubic meters (tcm), Nigeria is NOT a significant gas producer, extracting only small amounts of gas annually. While the marketed gas production increased threefold between 2002 and 2012, before hitting an all-time high of 49.4 bcm in 2020, output sharply dropped in 2022 by 18% from the 2020 level, reaching 40.4 bcm.

Nigeria also needs gas to address the local market, particularly the power sector. Gas consumption totaled 22.1 bcm in 2022, representing about 55% of local gas production, while the remaining output surplus was exported in the form of LNG. For the 2012-2022 period, gas consumption surged by 43%, as shown in Figure (1), a sign that local gas demand is notably growing faster than gas production growth.

Nigeria’s LNG Capacity

Keep reading with a 7-day free trial

Subscribe to Energy Outlook Advisors' Newsletter to keep reading this post and get 7 days of free access to the full post archives.