June 13, 2025

CNBC Interview on the Israeli attack on Iran and its impact on the oil market (this was over 20 ours ago, but many points remain valid):

https://x.com/anasalhajji/status/1933413435703804247

or:

Also:

https://x.com/anasalhajji/status/1933511409372958735

EOA: Iran’s Crude Oil Exports

Summary

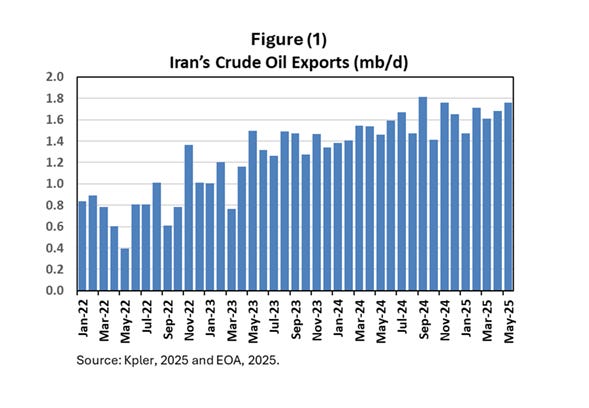

The Biden Administration ignored Trump’s Iran sanctions in 2021 to renegotiate the nuclear deal. As talks failed in late 2021 and enforcement was considered, Russia’s invasion of Ukraine led the administration to overlook sanctions in 2022 to offset lost Russian exports. We previously reported how the administration coordinated the release of the US SPR and Iran’s 80 mb of floating storage. In 2023 and 2024, sanctions were ignored due to elections, avoiding oil price spikes. This led to a steady rise in Iran’s oil production and exports, averaging 1.7 mb/d recently, as shown in Figure (1).

Given developments since last night and the 14% price surge, is the market pricing in the loss of Iranian oil exports? Is it anticipating Iranian retaliation affecting other countries’ oil supplies? Will shipping in the Strait of Hormuz be impacted? Answers below.

EOA’s Main Takeaways

Keep reading with a 7-day free trial

Subscribe to Energy Outlook Advisors' Newsletter to keep reading this post and get 7 days of free access to the full post archives.