EU's Gas Import Mix: Record LNG Imports in First Half of 2025. Gas Prices Expected to Rise

With 6 charts

The EU natural gas market in late 2025 is expected to face tight supply due to lost Russian pipeline gas, low storage, LNG competition from Asia, and possibly higher gas demand that expected if renewables do not deliver. Prices are expected to increase, potentially exceeding €45/MWh under certain scenarios, especially if hurricanes disrupt LNG shipments from the Gulf of America

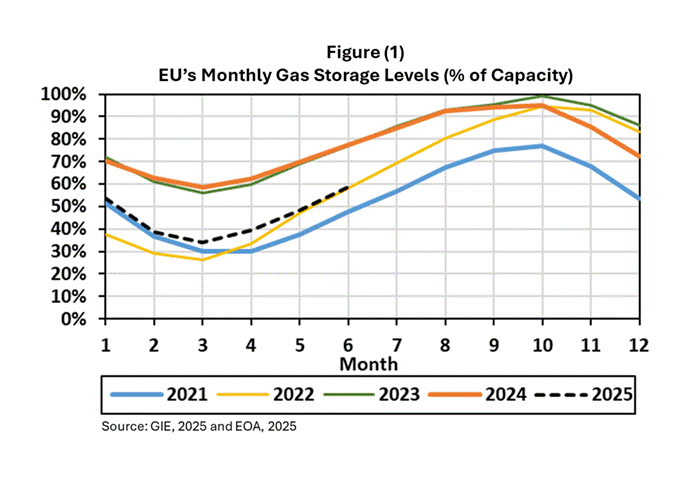

Strong injection demand persisted across Europe in June, as storage operators accelerated refill efforts for winter, sustaining upward pressure on TTF prices. By June 30, EU gas storage reached 58.9% capacity, up 10.5 points from May but below the five-year average (Figure 1).

Moderate summer temperatures and ample LNG inflows, especially from the U.S., offsetting reduced Norwegian pipeline imports and capped price surges.

Over the month, TTF gas prices fell by about 4.98% compared to the previous month, reflecting a broader trend of declining prices, though they remained 1.23% higher than the previous year. TTF prices settled at $11.4 per MMBtu by month-end.

In the Asian market, JKM prices rose from $12.30/MMBtu on June 1 to a four-month high of $13.10/MMBtu by June 30, a $0.80/MMBtu gain, or about 6.5%. The average price differential between JKM and TTF narrowed to approximately $0.70/MMBtu. Geopolitical tensions in the Middle East drove the increase, but prices later fell to the low $12s and late $11s due to weak demand and high inventories.

Gazprom’s Exports to Europe

Keep reading with a 7-day free trial

Subscribe to Energy Outlook Advisors' Newsletter to keep reading this post and get 7 days of free access to the full post archives.