EU's Gas Import Mix: Higher Gas Prices in Summer?

Will Ending the War in Ukraine Change the EU’s Energy Mix? (with 6 Charts)

Major Issues:

- Weather

- Trump’s Trade Wars

- Peace in Ukraine?

The gas market is becoming more global due to the LNG industry. We've seen the impact of this globalization in recent months: when demand was weak in Europe, LNG shipments were redirected to Asia. As demand and prices increased in Europe, shipments were diverted from Asia to Europe. In the last two weeks, the situation reversed, and Asian companies started snapping up spot cargoes to benefit from low prices. This development is significant: it prevented gas prices in Europe from rising to new records.

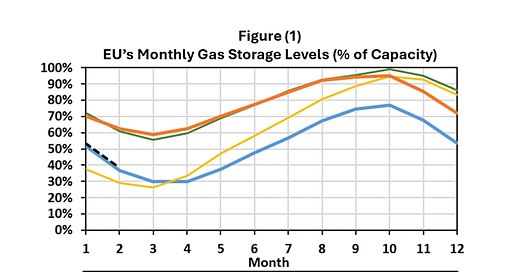

The TTF, Europe's gas price benchmark, rose sharply in early February, hitting $17.6 per mmbtu on February 10 due to colder weather, reduced wind power, and rapid gas stockpile withdrawals for increased heating needs. Consequently, gas reserves fell to 38.53% of capacity by February 28, down from 62.53% in 2023 and 61.03% in 2022, as shown in Figure (1).

Keep reading with a 7-day free trial

Subscribe to Energy Outlook Advisors' Newsletter to keep reading this post and get 7 days of free access to the full post archives.