EU’s Gas Import Mix: Europe Faces Volatile Gas Prices and Competition from Asia

Russia's gas exports to Europe increased by 10.3% month-on-month in May, and soared by 37.3% year-on-year (With 6 charts)

To assess the success of European efforts to shift away from Russian gas, the EOA issues a monthly tracker of the EU’s gas imports through pipelines from Russia, Azerbaijan, Norway, and North Africa (Algeria and Libya), as well as LNG cargoes from global players like the US, Qatar, and Nigeria. The tracker aims to highlight changes in the EU’s imported gas supplies and the extent of reducing dependency on Russia.

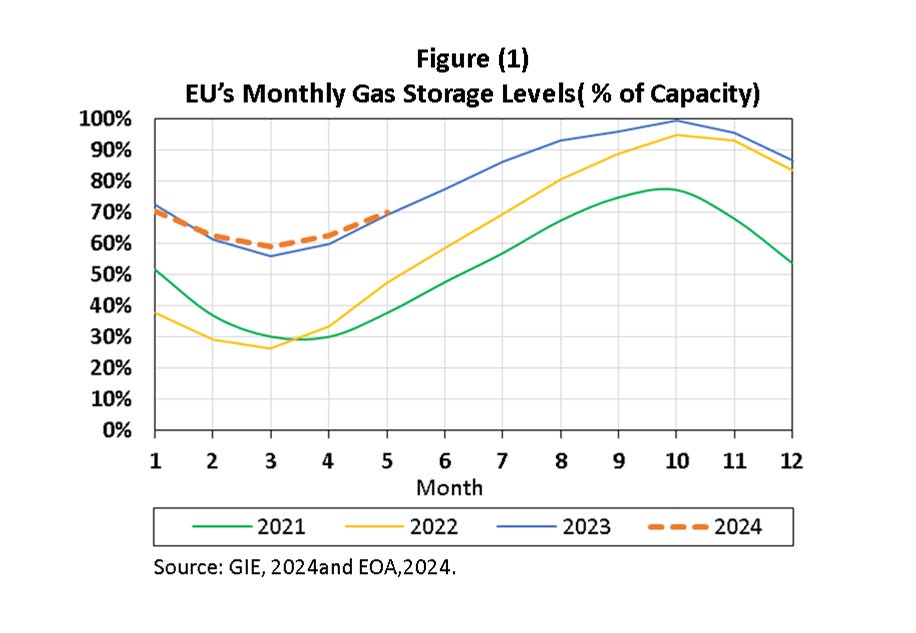

The European benchmark for gas prices, TTF, was up by 20% in May, reaching $10.87 per mmbtu by the end of the month amid concerns over unplanned outage in Norway, and competition from Asian customers over spot LNG cargoes. Meanwhile, gas storage levels in Europe remained historically high at 69.98%, or 1 percentage point higher year-on-year, and 19 percentage points higher than the past three-year average (Figure 1). Asia became more attractive for spot LNG cargoes as the price differential (JKM-TTF) was in favor of JKM, averaging $1 per mmbtu.

Gazprom’s Exports to Europe

Keep reading with a 7-day free trial

Subscribe to Energy Outlook Advisors' Newsletter to keep reading this post and get 7 days of free access to the full post archives.