EU November Gas Imports: Gazprom’s Shipments to Europe down 7.4% m/m

Cold snaps would reduce storage and raise prices in Q1, but low economic growth and industrial demand would prevent a spike (with 5 charts)

To assess the success of European efforts to shift away from Russian gas, the EOA issues a monthly tracker of the EU’s gas imports through pipelines from Russia, Azerbaijan, Norway, and North Africa (Algeria and Libya), as well as LNG cargoes from global players like the US, Qatar, and Nigeria. The tracker aims to highlight changes in the EU’s imported gas supplies and the extent of reducing dependency on Russia.

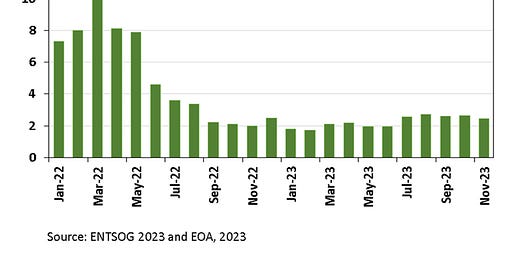

Gas shipments from the Russian energy giant Gazprom to Europe (EU and Ukraine) decreased by 7.4% month-on-month in November, reaching 2,440 million cubic meters (mcm), down from 2,640 mcm in October (Figure 1), according to the EOA’s calculations and data from the European gas transmission platform (ENTSOG).

Gazprom shipped 1,227 mcm of gas via Ukraine through the Sudja gas station on the Russian-Ukrainian border, out of which 125 mcm of gas was offloaded in Ukraine, while the remaining volume of 1,101 mcm was shipped to the EU member states. Gazprom’s daily gas exports through the Sudja metering point slightly dropped to 40.9 mcm in November, down from 41.2 mcm in October, the EOA calculated.

Meanwhile, the total gas volumes Gazprom exported via the TurkStream pipeline passing through Turkey, dropped to 1,217 mcm in November, down from 1,364 mcm the previous month.

Using the above-mentioned two transit routes, Gazprom gas shipments to the EU member states dropped by 4.7% month-on-month in November, reaching 2,318 mcm, down from 2,433 mcm in October.

Keep reading with a 7-day free trial

Subscribe to Energy Outlook Advisors' Newsletter to keep reading this post and get 7 days of free access to the full post archives.