[COPY] Strike Threat in Australia Could Cut Global LNG Supply by 10%

Although Australia’s LNG exports go to Asia, a labor strike will affect LNG supplies in Europe ( with a table and four charts)

Update on the strike story: LNG Strike Risks Drag On in Australia as New Talks Eyed

Last week, Australia’s labor regulator, the Fair Work Commission, gave the green light to vote on strike action at gas facilities operated by Chevron Corp and Woodside Energy Group, a measure that could disrupt LNG supplies from the world’s second-largest LNG exporter. A final call has yet to be made, according to Reuters, and Chevron and Woodside have been holding negotiations with Australian unions. While it remains unclear how workers will proceed, a major strike could disrupt LNG production and loading operations at the Gorgon and Wheatstone LNG export plants operated by Chevron, and Woodside’s North West Shelf (NWS) offshore gas platforms. The three LNG facilities (Gorgon, Wheatstone, and North West Shelf) have a combined nameplate capacity of 41 million tons per annum (mtpa), representing roughly 50% of total Australian LNG exports, or 10% of global LNG supply. For its part, Chevron has said that it had taken measures to maintain reliable operations at its facilities in the event of disruptions.

The news about strikes and negotiations to avert industrial action has had an immediate impact on the European Benchmark for gas contracts, amid concerns over potential LNG supply cuts. The Dutch TTF surged to a two-month high intraday, reaching 40 Euros/megawatt hour on August 9, up from 30 Euros/megawatt hour the prior day, but fell to 35.3 euros/megawatt-hour by the end of last Friday (August 11). US Henry Hub gas futures also surged to a 5-month high above $2.9 per metric million British thermal unit (mmBtu), amid concerns over growing LNG demand in the US due to the hot summer season, but they ended last week at $2.8 per mmBtu.

Australia’s LNG Industry

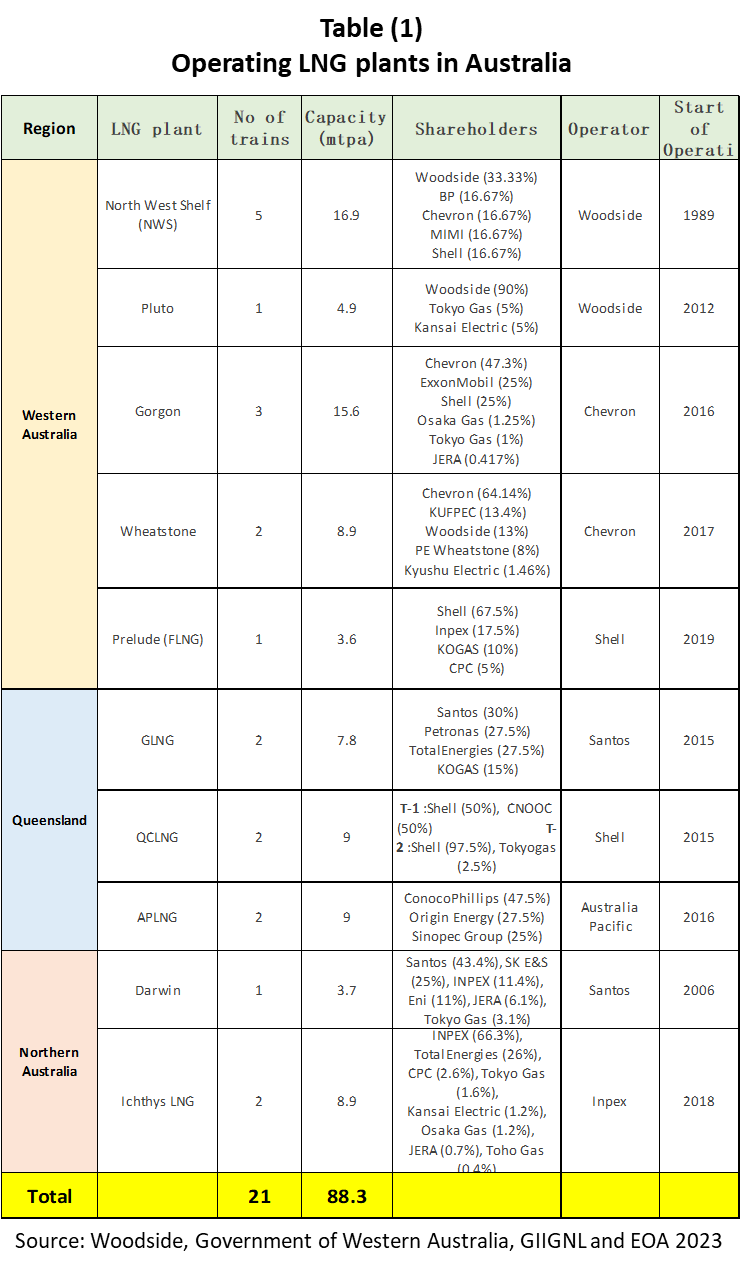

There are 10 liquefaction facilities in Australia located in three regions: Western Australia, Northern Australia, and Queensland in Eastern Australia. It is also worth noting that Australia’s domestic gas market is divided into three distinct markets in these areas, with different ownership and gas regulations depending on the location of gas resources.

Western Australia has an established LNG export industry with the state’s first LNG project, the North West Shelf (NWF), in place since 1989. The industry currently includes five operating plants: North West Shelf, Gorgon, Pluto, Wheatstone, and Prelude FLNG. Meanwhile, Northern Australia has two operating LNG plants: Darwin and Ichthys. In its turn, Queensland in Eastern Australia is home to three operating plants: Australia Pacific LNG (AP LNG), Gladstone LNG (GLNG), and Queensland Curtis LNG (QCLNG), as shown in Table-1 below. The ten operating LNG projects have an aggregated nameplate capacity of 88.3 mtpa, according to the EOA’s calculations, making Australia the world’s second-largest LNG capacity holder.

The Woodside-operated North West Shelf is the largest LNG plant, with a total nameplate capacity of 16.9 mtpa. The Chevron-operated Gorgon plant is the second largest one, with a total nameplate capacity of 15.6 mtpa, while the Wheatstone facility, also operated by Chevron, has a capacity of 8.9 mtpa.

Impact of Potential Strike on Global LNG Supply

This year, Australia’s three LNG plants, Gorgon, Wheatstone, and NWS exported 20.02 million tonnes (mt) of LNG between January and June, according to data compiled by the EOA using ship tracking data (Figure 1), representing 50% of the country’s LNG output, and about 10% of global LNG supply over the same period. These figures highlight the potential implications on global LNG supply if workers take industrial action. Last June, LNG output from the three facilities totaled 3.5 mt, which was equivalent to 40% of the European Union’s LNG imports during that month.

How Will a Strike Affect Importers?

In 2022, Australia's LNG exports totaled 78.5 million tons, just shy of Qatar’s 79 million tons, while US LNG exports totaled 75.43 million tons, according to recent data from GIIGNL, the International Group of Liquefied Natural Gas Importers. Unlike its competitors Qatar and the US, almost all of Australia’s LNG output is sold in Asia. Most Australian LNG is sold under long-term contracts with Asia’s top importers (Figure 2), namely Japan, China, and South Korea which had a share of 81% of Australia’s LNG deliveries in 2022.

Of the three Australian LNG facilities that are facing strike threats, Japan received the lion's share of total exports, or 43% between January and June of 2023, followed by China at 21%, Taiwan at 12%, and South Korea at 10% (Figure 3 ). Based on this, any industrial action will mostly affect Japan.

Impact on Europe

The super-chilled fuel has become a major component of Europe’s gas import mix. Following Russia’s invasion of Ukraine, the European Commission took a set of actions to reduce its reliance on gas supplies from Moscow in the short term and halt flows by 2027. To that end, Europe has increased LNG purchases from the global market to compensate for lost Russian gas and promote its security of gas supply. As a result, LNG has become the favorable option for many European countries that have access to the global market, and the fuel’s share in the EU’s gas import mix has sharply increased to 44-50% (Figure 4).

The EU’s growing dependence on global LNG to meet its gas needs and shift away from Russian energy supplies has made the continent more vulnerable to global LNG supply shocks, with an increasing risk of gas price volatility. The global LNG market is still supply-tight, with about 60% of supplies originating from three key producers: Qatar, Russia, and the US. Any LNG supply disruption from these market players, or any other significant supplier, will have an impact on Europe, which will have to offer higher prices to attract spot LNG purchases away from Asian markets.

Conclusions

This is not the first labor dispute that has taken place at Australia’s LNG facilities. A similar one happened last year at the Shell-operated Prelude FLNG facility, and it required over two months to be resolved. If workers move ahead with the strike, Asian buyers are expected to bid up to attract more LNG from the spot market to balance any shortfalls. Such a situation will affect the market fundamentals in Asia and consequently, Europe which is heavily dependent on spot LNG purchases. EOA