Dear Readers,

As COP28 is being held in Dubai with the oil industry participating in such events for the first time, the oil industry wasted no time making its case. We decided to repost this article for everyone to read.

A few Headlines:

AP: Emirati Oil CEO Leading COP28 Lashes Out as Talks Enter Toughest Stage

The Guardian: Cop28 president says there is ‘no science’ behind demands for phase-out of fossil fuels

MarineLink: ExxonMobil CEO Rebuffs IEA Criticism of Carbon Capture Strategy

EOA’S MAIN TAKEAWAYS

Data indicates that future demand for oil and gas is UNDERESTIMATED, while demand destruction is HYPED.

Global energy demand is increasing, making decarbonization more difficult to achieve, and the process of replacing fossil fuels slower.

Despite massive spending on renewables in the last two decades, fossil fuels remain the dominant source of energy in the world, even in Europe.

Coal remains the dominant source of electricity in India and China.

Oil is rarely used in power generation in the OECD, China, and India. Doubling or tripling solar and wind energy sources will have a very limited impact on oil demand. However, the failure of renewable energy, and consequent power shortages, will have a significant impact on oil demand.

As LNG prices reached a record high in 2022, oil use in power generation increased. The level of substitution among various energy sources last year was unprecedented.

INTRODUCTION

Global energy demand will continue to grow until the global population declines and urbanization ends. But we all know this will take a very long time. To meet the growing demand for energy, we need ALL energy sources, ALL technologies that improve energy efficiency, and all kinds of transportation technologies (even those who do NOT believe in climate change know that pollution in big cities is a serious problem and something needs to be done about emissions). While we need renewable energy, especially solar and wind, and green hydrogen, we also need fossil fuels.

We support all energy sources, various technologies, and “alternative” vehicles, including EVs, but we are against hype and wishy-washy energy policies.

TotalEnergies CEO Patrick Pouyanne, summed up these issues in an interview with CNBC last week, saying:

"Today, our society requires oil and gas … Why we are together, it is 80% of fossil fuels. There is no way to think that overnight we can just eliminate all that and rely only on 10% of low-carbon energy. It will take decades to build a new system,"

"If we don't invest enough, the [oil] price will not be $75 per barrel, it will be $150 or $200 and all consumers will be super unhappy and our life will be a nightmare,"

"So … producing with strict new standards demonstrating that we can produce oil and gas in a very smart way with lower emissions. At the same, we invest in the new low-carbon energy, and we do it in a large way."

- "So, let's keep this balanced. It's difficult. I know the scientists told us you should forget [fossil fuels] — but life is like it is. We must make that transition at a pace which can be accepted by the society. That's also one condition of the success."

Reality in Numbers

What Pouyanne said, and at the time when oil majors, such as Shell, are refocusing their attention on investing in oil and gas, captures the reality of the global energy landscape: despite spending trillions of dollars in recent years to reduce dependence on fossil fuels, the world remains dependent on oil, gas, and coal. Even countries like Germany still rely on fossil fuels.

As we mentioned in a previous report, the largest investor in renewable energy in the world is China. To achieve carbon neutrality at this pace of investment, China needs 211 years. But here’s the catch: this number assumes all current renewable projects are going to remain in place forever, and that they won’t require new investments when they expire after 25-30 years. What this indicates is that achieving carbon neutrality by 2060, or even later, is a pipe dream.

Below are charts showing global energy consumption by source in 2022, with a focus on some regions and countries. The result is clear: there is a lot of hype surrounding the energy transition, and it is costing taxpayers trillions of dollars for almost nothing. Our calculation shows that if all cars in the EU are switched to electric, and all electricity starts coming from renewable energy, global CO2 emissions will decline by only 2%. If every car, truck, plane, boat, and farm equipment in the US is replaced with an electric equivalent, global CO2 emissions will decline by only around 4.6%! We are not saying that we need to stop fighting climate change. We are arguing that a realistic approach to energy transition is needed.

Global Primary Energy Consumption by Source

Figure (1) below shows that global energy consumption has been increasing except in periods of recession, while fossil fuels have been and still are the dominant form of energy. It also shows that natural gas consumption has increased in recent years and that despite the rise in solar and wind power, their share remains small. Figure (1) also reveals that oil lost market share after periods of high prices (prices are not shown).

Figure (2) on global primary energy consumption by source, shows that about 82% of the energy consumed in 2022 came from fossil fuels. Despite spending more than $4 trillion on renewable energy since 2010, its share was only 7% of primary energy consumption, as shown in the figure below. How much more money will be needed to replace only half of used fossil fuels, and how long will this take?

Turning to Figure (3) below, it shows that despite all efforts to decarbonize, 71% of the energy used in 2022 came from fossil fuels. The declining population in some European countries, accompanied by the penetration of electric vehicles, will reduce oil demand in these places. But the impact of electric vehicles on oil demand remains a myth.

Demand for gasoline increased in most European countries in the first half of 2022, and even in Norway where sales of electric vehicles exceeded 90% of total sales. Data on fuel consumption in Norway indicates that the decline over the last few years has been lower than the level that would be reached due to sold electric vehicles.

Figure (4) below shows that about 81% of primary energy consumed in 2022 came from fossil fuels. The share of coal shrank in recent years as the share of natural gas and renewable energy increased.

Moving to Figure (5), it shows that China spent more than any other country in the world on renewable energy, and by a large margin, and yet, 55% of its primary energy consumption came from coal, and 82% from fossil fuels. Even if China doubles its investment in renewable energy, it will take more than 100 years to achieve the drive needed for carbon neutrality! Therefore, those targets to achieve carbon decarbonization by 2060 are only targets on paper.

Figure (6) below on primary energy consumption in India, indicates that the story is not that different from China, but India’s capabilities are significantly smaller, and its dependence on coal and oil is way higher.

A coal-fired power plant in China's Jiangsu province. XU CONGJUN - IMAGINECHINA (E360, Yale University.

Electricity Generation by Source

Some claim that the role of fossil fuels in the electricity sector is different from other domains. We disagree with this, and for this reason, we share below a chart on global electricity generation by source for the world, followed by charts on Europe, the US, China, and India.

Figure (7) below shows that coal remains the dominant source of power generation in the world (33%), followed by natural gas (23%), and hydroelectric, (15%). After spending trillions of dollars on renewable energy in the last 15 years, power generation from renewables was only 14% of total generation in 2022! While 9% of total generation came from nuclear, only 3% was from oil. This small percentage coming from oil was mostly in oil-producing countries, poor developing countries, and isolated places, mostly islands. That means expanding renewables will have a very limited impact on oil demand.

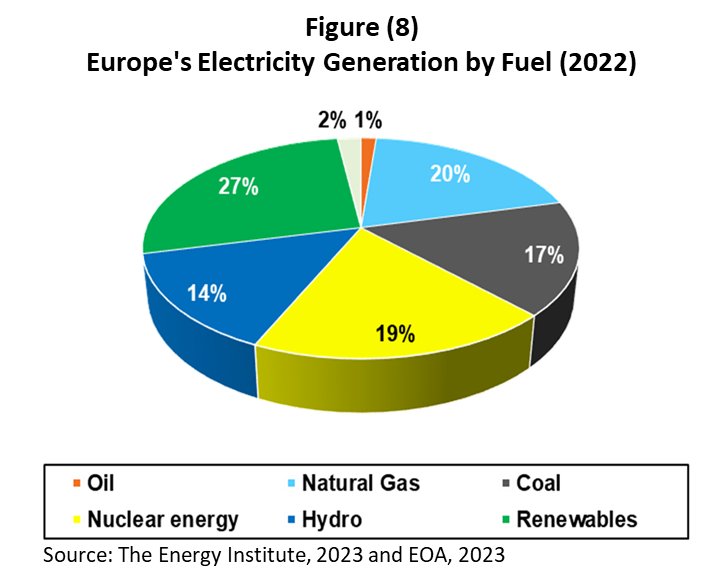

Figure (8) below presents sources of power generation in Europe in 2022. The largest share came from renewable energy (solar and wind) at 27%, followed by natural gas (20%), nuclear (19%), coal (17%), hydroelectric (13%), others 2%, and oil (1%). However, any additional changes to these percentages will be costly and difficult to achieve. A declining population with limited or negative growth would help reduce the role of coal, but given the small percentage of oil in power generation, doubling or even tripling renewable energy may not have an impact on oil demand in Europe.

Figure (9) shows US power generation by source in 2022. About 40% of total power generation came from natural gas, followed by coal (20%), nuclear (18%), renewables (16%, and hydroelectric (6%), while oil was only 0.55%.

Again, despite major policy changes, subsidies, and massive investments in the last 15 years, electricity generated from solar and wind was only 16% of total generation. Given that oil is rarely used to generate electricity, increasing renewables will not affect oil demand.

Figure (10) on China reveals that those who think the giant Asian fossil fuel consumer can achieve carbon neutrality this century need to think again. China is the largest spender on solar and wind energy in the world. Yet renewable energy generates only 15% of total generation, while 61% is generated by coal. As we mentioned above, given the current level of spending, China needs 211 years to achieve carbon neutrality, assuming all projects – current ones and those that will be built— will remain in operation forever.

If you think China is a problem, wait until you see India. If China needs at least 211 years at current spending on renewables, India will require more than 400 years. Figure (10) below on India’s’ power generation in 2022, shows that coal generated about three-quarters of its electricity. Solar and wind, meanwhile, generated 11%. Given that India’s economy is growing and expected to continue to grow in the next two decades, spending more on wind and solar will be barely enough to meet demand, and for this reason, it will not substantially reduce the share of coal. Notice that oil is rarely used in power generation, an indication that using more renewables, natural gas, and nuclear will have no impact on oil demand.

CONCLUSIONS

Most countries, if not all, will not achieve their targets of carbon neutrality, or net zero, by 2050 or 2060. The data above shows that fossil fuels are entrenched and hard to reduce, let alone get rid of them. The hard reality is that we have spent more than $4 trillion on solar and wind energy since 2010, and yet they are showing little progress on the energy landscape.

In economies where high economic growth is expected in the coming years, almost all investments in renewable energy will go to meet demand growth, and not to replace coal or gas.

The data we shared in this report shows that many of the countries spending most of the money on renewable energy rarely use oil in power generation. Therefore, even a massive expansion of renewable energy will have a very limited impact on oil demand.

While electric vehicles are not the subject of this article, some readers may ask about their role. Our view is that the increased penetration of electric vehicles will reduce oil demand growth but will not reduce demand. Oil demand will peak in some countries but will not peak worldwide until the number of electric vehicles exceeds 700 million vehicles. We are currently at around 30 million EVs.

While the expansion of renewables will have a very limited impact on oil demand, the failure of renewables, on the other hand, will result in significant consequences. Since 2004, power shortages, especially during scorching summer months, have led to an increase in power generation using mostly diesel and LPG. Such demand is not counted as part of power generation and is not forecasted in advance.

The main takeaway from the data presented in today’s report is that demand for oil and gas in the future will be higher than current expectations. Some of the existing forecasts support political wishes and government targets, but they don’t show what will actually happen based on the data. Some will come to terms with reality when countries start experiencing successive energy crises.

We believe that the narrative is changing, and we might see this change clearly at COP28 in the UAE later this year.EOA