2022 Oil Market Review: Trends, Events, and Lessons Learned

MAIN TAKEAWAYS

2022 was a historic year for global energy markets, marked by large-scale government interventions and controls.

Economic sanctions and price caps do not work. Russian oil production and exports have not collapsed as some pundits predicted.

US President Joe Biden’s successful Strategic Petroleum Reserve (SPR) releases settled the debate in favor of keeping the SPR as an economic and political tool.

Despite challenges and unprecedented hostilities, world oil reserves and production increased.

Saudi Arabia remains the main player in the global oil market and has the ability to influence the oil market in multiple ways.

US oil saved Europe in the past, and in 2022 US LNG came to the rescue thanks to the US shale revolution.

US shale oil production increased, yet crude quality remains a problem.

Growth in global oil demand in the last 20 years hinged on China’s economic growth. In 2022, oil producers were lucky: the COVID lockdowns in China took place while the rest of the world was recovering from the pandemic amid supply chain disruptions due to Russia’s invasion of Ukraine. Without these factors, the oil and gas markets would have collapsed.

Climate change policies are “luxury goods.” They are ignored when governments cannot afford them.

FROM LAST WEEK’S HEADLINES

TC Energy returned the Keystone Pipeline to service on Dec 29 after completing the required repairs, inspections, and testing.

US refineries and Gulf coast ethylene units have been gradually coming back online following the brutal winter storm, according to Reuters and Argus Media.

Russian President Vladimir Putin signed a decree on Dec 27 banning oil sales to countries abiding by the G7-led price cap. The decree will go into effect on Feb 1, 2023, and remain in place until July 1, Russian media reported.

Reuters cited sources on Dec 29 as saying Poland “is seeking German support to slap EU sanctions on the Polish-German section of the Druzhba crude pipeline so Warsaw can abandon a deal to buy Russian oil next year [2023] without paying penalties.”

Russian Deputy Prime Minister Alexander Novak, meanwhile, claimed on Dec 26 that Germany and Poland had applied to receive oil via the Druzhba pipeline, but it’s unclear if the oil will be Russian or Kazakh, according to Russian media.

Novak also noted Moscow was “ready to resume” supplies via the Yamal-Europe pipeline amid gas deficit in Europe. He also said Moscow was considering the possibility of sending additional gas supplies via Turkey, once and if, a hub becomes a reality. See our analysis on this subject here.

The US Treasury issued on Dec 30 a preliminary guidance on the implementation of the price cap on Russian petroleum products which will go into effect on Feb 5. The Treasury said that Russian petroleum products “loaded onto a vessel at the port of loading prior to 12:01 a.m. eastern standard time, February 5, 2023, and unloaded at the port of destination prior to 12:01 a.m. eastern daylight time, April 1, 2023, will not be subject to” this price cap measure.

China is expected to scrap COVID-related quarantine measures on travelers visiting the country starting Jan 8, Bloomberg reported.

On Dec. 25, Saudi Arabia and Japan signed a memorandum of cooperation related to clean hydrogen and fuel ammonia, as well as carbon economy, according to media reports.

Egypt has announced a new international tender for oil and gas exploration rights in the Nile Delta and the Mediterranean Sea, according to an official statement carried by Reuters.

Venezuela’s leading opposition parties have removed US-backed Nicolás Maduro from power and put an end to the so-called interim government he once led in a bid to oust President Nicolás Maduro.

For the first time since 2011, top Syrian and Turkish officials held talks in Moscow on Dec 28, as Ankara and Damascus seek to end years-long hostilities. Turkey is still considering another military incursion against Kurdish forces in northeast Syria and will need Russia's support on that, according to a report by the Wall Street Journal.

Iran-aligned armed groups in Iraq are expected to organize marches tomorrow (Jan 3) to commemorate the third anniversary of the US killing of top Iranian general Qassem Soleimani in Baghdad. Attacks may target sites linked to the US. However, we don’t expect an escalation.

There have been reports about concerns in Iraq regarding the drop of the Iraqi dinar against the US dollar. On Dec 27, one US dollar traded at 1,580 Iraqi dinars against the central bank rate of 1,470 dinars, according to local media. Some reports have partly attributed this drop to US restrictions on some Iraqi transactions including those with Iran.

TO THE POINT

The energy crisis in Europe and western sanctions on Russian oil will remain the leading headlines this year. After the G7 and the European Union imposed a $60-price-cap on Russian crude oil on Dec 5, another price restriction on Russian petroleum products is expected to go into effect on Feb. 5. The US Treasury has already issued preliminary guidance on the implementation of the price cap, saying Russian petroleum products “loaded onto a vessel at the port of loading prior to 12:01 a.m. eastern standard time, February 5, 2023, and unloaded at the port of destination prior to 12:01 a.m. eastern daylight time, April 1, 2023, will not be subject to” the price cap measure.

As Europe and Asia look for alternatives to Russian gas supplies, new trends are appearing in the market with some gas producers seeking to fill the Russian gap. Oman, for instance, is looking to play a stronger role in the LNG market. Last Dec, Japanese companies inked several deals to receive LNG supplies from Oman LNG (a 10-year deal) according to a report by Reuters. Meanwhile, Asyad Shipping, Oman’s global integrated logistics service provider, struck an agreement with South Korean Hyundai Samho Heavy Industries to receive two LNG carriers, saying this was “another landmark in the Group’s expansion plans to bolster its energy logistics capabilities and meet growing global demand”, the Oman Observer reported.

Meanwhile, China’s ongoing steps to scrap COVID-related measures will continue to be monitored closely for any potential impact on global oil demand, and the global economy in general. Concerns about spillover from the new wave of COVID in China have yet to ebb. Positive cases are still rising while Beijing continues to curb COVID controls without a clear strategy to contain the virus. China’s Lunar New Year holiday travel season, meanwhile, which will start on January 22, has forced some countryside regions in China to prepare their medical facilities as millions of workers return from cities where COVID cases have been surging, according to Reuters.

Turning to Japan, the world’s third-largest economy, it will remain a key market to monitor after the Bank of Japan’s surprising decision in Dec to relax tight limits on bond yields, a step seen as paving the way toward future interest rate hikes.

On the geopolitical front, the EOA will be closely monitoring Iraq, OPEC’s second-biggest producer, as security, economic, and political risks remain high, amid an ongoing tug-of-war between neighboring Iran, and the US. Turning to Syria, some countries have already started to gradually mend ties with the Damascus-based regime, with Turkey being the latest. Ankara though is still considering a military incursion against Kurdish armed groups in northeast Syria.

2022 Oil Market Review

2022 will go down in energy history as one of the most important years. The energy developments, government interventions, energy policies, and the impact of all these were unprecedented. The skyrocketing prices of electricity and natural gas in Europe— which climbed to an all-time record—and the U-turn several European countries made on climate change policies as they returned to coal and oil-fired power generation, showed how 2022 was a year of surprises. However, our focus in this week’s newsletter is only on the oil market.

Last year saw the largest SPR releases in US history. It was also the year during which a package of sanctions was slapped for the first time in history on a major oil exporter. Additionally, the COVID lockdowns in China, the world’s biggest oil importer, could not have been imagined three years ago.

We focus below on the major events in the oil market last year. This is followed by a review of world reserves, production, and demand in 2022 with supporting data and charts. We also review oil production by source and oil trade before concluding with a list of lessons learned from all these events and trends.

Key Oil Market Events in 2022

IN-DEPTH

1- Russia’s Invasion of Ukraine

Impact: Russia’s invasion of Ukraine caused major changes in trade routes and led to higher shipping costs.

Results: Russian oil continued to flow, though at significant discounts, despite several rounds of western sanctions, and a price cap.

Lessons Learned:

Sanctions do not work. They do not change the behavior of the sanctioned country. Instead, they redirect the flow of oil to less efficient routes.

Price caps are ineffective when they are above market prices.

Russia’s invasion of Ukraine in itself had a very limited impact on oil markets. It was the global reaction to the invasion that affected the oil market. At first, insurance companies, banks, and various businesses refused to deal with shippers of Russian oil for fear of punitive measures taken by their governments, or lawsuits. Some buyers also shied away for the same reason. As a result, the prices of Russia’s flagship Urals crude oil nosedived, which prompted importers in Asia to purchase additional cargoes of heavily discounted Russian crude.

The Russian government, along with Russian oil companies, realized they needed to reroute crude shipments to Asia before it was too late, especially when western powers were locked in talks over imposing sanctions on Russia’s oil (see Figure 1). The US and the European Union wanted to punish Russian President Vladimir Putin for his invasion of Ukraine, but they also needed Russia’s oil to keep flowing to avoid a hike in global oil prices. Even when western powers imposed sanctions in early December 2022, they limited them to Russia’s seaborne crude exports and granted exemptions to certain countries.

Unlike what some experts had predicted, Russian oil exports remained steady, as oil cargoes started to head eastward and to some countries in the Gulf region (OPEC+ members). Despite a package of sanctions and a price cap, Russian oil exports have yet to drop as shown in Figure (2) below.

Although several leading oil and gas companies and oil service companies announced their solidarity with Ukraine, they did not cut ties with Russia. Instead, they pledged not to carry out new investments in Russia, and this is one of the reasons why Moscow has been able to maintain oil output and exports. Baker Hughes’s Russian subsidiary remains intact. It sold the company to its employees!

Figure (1)

Figure (2)

2- The US Administration’s SPR Releases

Impact: The SPR releases caused a major reversal in crude oil prices, prevented an increase in imports of sour crude oil, and increased exports, especially to Europe.

Results: The SPR releases reduced gasoline prices in the US, limited OPEC+ influence, and reduced Russian oil revenues.

Lessons Learned: The SPR releases are effective in achieving economic and political goals when released in large quantities using the right strategy.

Probably the biggest surprise for the oil market in 2022 was the release of 180 million barrels (mb) over a period of six months, and the successful results of this US policy. Before the SPR release announcement, many analysts had predicted an increase in oil prices to $150/b, and even $200/b. The SPR releases, however, did not only prevent oil prices from increasing, they were among the factors that lowered oil prices significantly.

The SPR release policy was successful for two main reasons: the releases were large and were accompanied by official statements that affected the market’s sentiment. The US administration announced that it was going to release 1 mb/d over six months until prices declined. This was different from past withdrawals of small oil quantities from the SPR and which were not backed by any effective official rhetoric.

Despite the large releases, the US still has around 375 mb in the SPR, as shown in Figure (3) below, which is more than enough to cover any emergency.

Historically, many US politicians across the political spectrum wanted to either end the SPR, since they saw it as a form of government intervention or reduce its size. Following the US shale revolution, many wanted to reduce the size of the SPR because of the massive increases in US oil production and the halving of crude oil imports. If the SPR was created to cover disruptions in oil imports, now oil imports are half of what they were and about one-third of what was expected before the shale revolution.

Almost all US current oil imports are medium/heavy and sour crude oil, and there is no need to store large amounts of light sweet crude, which is produced from shale plays. The US needs sour crude specifically to cover any shortages.

As for the negative impact of SPR releases, some in the oil industry have argued that such large withdrawals have reduced or delayed upstream investments. However, there is no hard evidence to support these claims.

Figure (3)

3- The Role of Saudi Aramco’s OSPs

Impact: Aramco’s OSPs had a major impact on oil flows and demand in 2022

Results: Aramco’s OSPs led to demand growth management and changes in the direction of trade.

Lessons Learned: Saudi Arabia will continue to be the main player in the global oil market.

OPEC+ played a significant role in balancing the oil market in 2020 and 2021. In fact, the most important development in the oil market in 2021 was the behavior of large producers with spare capacity within OPEC. It was the first time in OPEC’s history that large producers did not exceed their quotas as oil demand and prices increased. Historically, every time demand and prices rose, large producers with spare capacity hiked production above their quotas to cover the gap created by the failure of other OPEC members to raise production. This behavior, however, left OPEC ineffective and many members displeased.

Although the market always waits for the OPEC+ decision to increase or decrease quota/production, this has no impact until Saudi Aramco releases its official selling prices (OSPs). In general, the OSPs can either support an OPEC+ decision, nullify it, or have a neutral impact. The OSPs last year gained additional significance as Russia shifted its oil exports eastwards. Higher Saudi OSP to Asia meant that China and India were going to buy cheap Russian crude, while the Gulf States were going to reroute their exports from Asia to Europe to cover the gap left by Russia. This further accentuated Saudi Arabia’s leading role in the oil market.

Saudi Arabia has a spare capacity, flexibility to change production, pricing power, and the ability to penalize those who do not implement OPEC’s decisions. The events of March 2020—when Saudi Arabia decided to punish Russia for not cutting oil production— are still remembered very well by many in the oil industry.

Aside from the influence which the OPEC+ oil policy and Aramco’s OSPs can have on the market, other OPEC members can also exert influence through inventories: producers can maintain production according to the OPEC+ quota but reduce supplies by storing oil. Or they can maintain production but increase supplies by exporting from storage without violating the OPEC+ quota. In this case, the market will only see an increase in supply. This has caused confusion among analysts and observers who usually think that a producing country is increasing production and violating the OPEC+ quota, while in reality its supplies are being withdrawn from inventories.

Figure (4)

4- European Reactions to High Energy Prices

Impact: European measures paused the rise of energy prices, thus preventing higher rates of inflation.

Results: The results of these measures will benefit the existing governments only in the short term.

Lessons Learned:

Governments remain powerful and ready to intervene.

Politicians will always favor short-lived results.

Climate change policies are “luxury goods.” They are ignored when governments cannot afford them.

The major response to soaring energy prices came from the US when the Biden administration decided in March 2022 to release 180 mb from the SPR (as we discussed in the previous section). The International Energy Agency (IEA) also requested its members to release 61 mb.

To address rising prices, many green energy advocates in Europe gave up on certain pillars of their climate change policies. Some governments did not only return to using coal and oil in power plants, they also went back to managed economies after making major steps toward free markets. While some European countries resorted to price controls, others embraced fossil fuel subsidies and windfall profit taxes. We share below some examples.

Germany

In October, German lawmakers approved a 200-billion-euro ($195bn) energy fund proposed by the government to tackle soaring energy prices affecting industries and households. The fund is expected to remain effective until next year(2024) and will be dedicated to price caps and subsidies, according to a report by DW.

Regarding energy price ceilings, gas prices will be capped at 12 euro cents per kilowatt hour for consumers as well as small and medium businesses, according to a report by AP. Electricity prices, meanwhile, will be capped at 40 euro cents only for “80% of their previous year’s consumption.”

Italy

In November, Italy gave the green light to a plan worth 9 billion euros ($8.96 billion) in an attempt to address the impact of skyrocketing energy prices, and support the economy, according to a report by Reuters.

This set of state measures included a plan to help companies pay energy bills in around 36 installments, and which would carry a guarantee in the event of default on payments, according to Reuters. The package also includes canceling taxation on fringe benefits given out to workers to assist them with their burgeoning energy bills. Another measure as part of this package is related to bolstering energy security by dedicating 4 billion euros to increase gas storage, according to Reuters.

United Kingdom

The UK saw a change in governments late last year with each having its own scheme to address the impact of high energy prices.

In October, while Prime Minister Liz Truss was still in office, the government introduced a new Energy Prices Bill to support households, businesses, and other sectors. The powers introduced by the bill enabled: an Energy Bill Relief Scheme, an Energy Price Guarantee, an Alternative Fuel Payment, and heat network support, among others.

The Energy Bill Relief Scheme (EBRS) “will enable the government to provide financial assistance on energy bills for all eligible non-domestic customers, including businesses, charities, and public sector organizations”, a measure which went into effect in Oct 2022, according to a government press release. The Energy Price Guarantee, meanwhile, “will ensure that a typical household in the United Kingdom pays around £2,500 a year on their energy bill, depending on their use, for the next 2 years [2023 and 2024].”

Also in October, the UK parliament passed the so-called Energy Prices Act 2022 which is a bill “to make provision for controlling energy prices; to encourage the efficient use and supply of energy; and for other purposes connected to the energy crisis.”

In late December, there were media reports about possible plans by the UK government to “halve financial support” on businesses’ energy bills.

France

In November, France said it was going to spend 8.4 billion euros to assist companies with their high energy bills. This assistance includes slashing a tax on electricity, and a special mechanism through which companies can obtain cheap nuclear power, Reuters reported. A month earlier, France announced it was planning to spend 45 billion euros to protect households and businesses from high energy prices.

Greece

In December, Greece said it was going to boost subsides on energy bills up to 840 million euros starting this month (Jan). This is double the amount of subsidies for power announced for households and businesses in Dec, according to local media.

Spain

In October, Spain announced a 3-billion-euro package of subsides to help households with soaring electricity and gas prices. The approved measures included “set price rates for collective residential heating systems” until the end of this year, and extra subsidies on power and heating consumed by low-income households, according to a report by AP.

Windfall Profit Taxes

In September, the European Union approved a windfall tax to limit surplus profits reaped by fossil fuel companies in 2022 and this year. A tax on low-cost electricity producers was also approved, as well as a compulsory 5% cut in power consumption during peak price periods, according to Reuters.

Several European counties have slapped windfall taxes on energy companies as part of measures taken to address soaring energy prices. These countries have included Bulgaria, Austria, Czech Republic, France, Germany, Finland, Italy, Greece, Norway, the Netherlands, UK, among others, according to a report by Reuters.

EOA’s View on Subsidies and Windfall Taxes

Subsidies go against the economic and environmental policies that some European countries have been adhering to, and for this reason, they are politically motivated. Furthermore, subsidies don’t reduce demand, but they at least prevent it from declining. In addition, subsidies create an additional burden on the state budget at a time when European governments need to stimulate the economy following the pandemic and Russia’s invasion of Ukraine. In short, European countries will pay dearly for their subsidies in terms of financial and environmental costs.

Some governments think that one way to reduce the financial burden of subsidies is to impose excise profit taxes on oil companies. However, this creates another problem. Taking the UK as an example, an excise profit tax has forced companies to reduce spending and divert investments outside the UK. In addition, oil companies that wanted to use additional profits from high oil prices to invest in renewable energy projects, especially offshore wind, have canceled these plans. Therefore, the results were lower investments and lower future energy supplies.

2022 in Numbers and Charts

Oil Prices

Oil prices continued their upward trend in the first quarter of 2022 due to the OPEC+ measured actions, global recovery from COVID, and Russia’s invasion of Ukraine.

Russia’s invasion of Ukraine and western talks of sanctions on Moscow sparked fears that Russian oil exports may decline by a few million barrels, at a time when the remaining spare capacity within OPEC was very low. But after Brent prices climbed to over $130/b, it then became clear that:

China was struggling and lockdowns were going to have a heavy impact on global oil demand;

The appreciation of the US dollar was wreaking havoc on oil demand;

Sanctions were not going to be effective, and Russia was able to maintain its oil exports, knowing that Europe and the US could not afford the sudden loss of some Russian oil during that period;

The “expected” large growth in global oil demand was an exaggeration;

OPEC had enough spare capacity to meet the increase in demand in 2022; and

Most importantly, the Biden Administration and the IEA were going to withdraw oil from the SPR.

All these factors later put downward pressure on oil prices. And when it became clear to many traders and analysts that the impact of the 180 mb released from the US SPR was larger than expected, and that Russian oil exports were stable, prices declined further.

Some analysts and traders thought that EU sanctions on Russia, along with the G7-led price cap and the end of SPR withdrawals were going to increase prices in the fourth quarter, while some investment banks expected oil prices to increase to $125/b. However, the opposite happened, and Brent prices dropped to $80/b. Western sanctions on Russian oil and the price cap, as well as the halt in SPR withdrawals, have had a limited impact as we discussed above, as well as in our previous newsletters.

Figures (5) and (6) below show Brent and WTI prices.

Figure (5)

Figure (6)

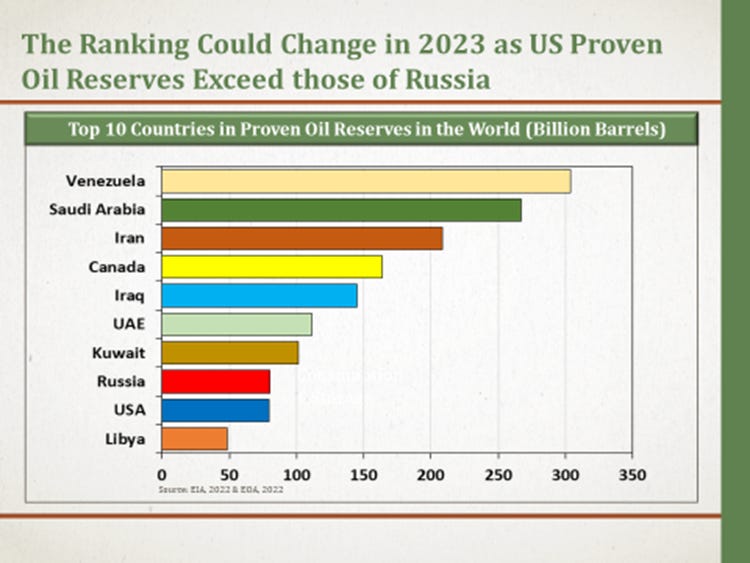

World Oil Reserves

The world’s proven oil reserves rose by 22 billion barrels from 1,735 billion barrels at the end of 2021 to 1,757 billion barrels at the end of 2022, according to the Oil & Gas Journal. While 22 billion barrels may not sound like a large quantity, the increase happened even though the world produced about 34 billion barrels during the same period, and after years of low oil investments. The increase reflects upward revisions in some countries, and the addition of Guyana’s 11 billion barrels in reserves for the first time—contributing to about half of the increase in the world’s oil reserves.

According to the Oil &Gas Journal, proven oil reserves increased slightly in the Asia-Pacific region, mostly in China and New Zealand, as they declined in Australia, Indonesia, and India.

Meanwhile, proven oil reserves dropped in Western Europe by 4.5%, mostly in Norway, the UK, and Denmark. They also declined in Canada for both conventional and oil sands, and in Mexico.

In South America, proven oil reserves increased in Brazil and Argentina. As mentioned earlier, Guyana’s oil reserves have been reported for the first time, standing at around 11 billion barrels.

OPEC’s reserves remained flat. However, the rise in the oil reserves of some members, namely Saudi Arabia and the UAE, covered the decline in reserves of other oil producers within the group.

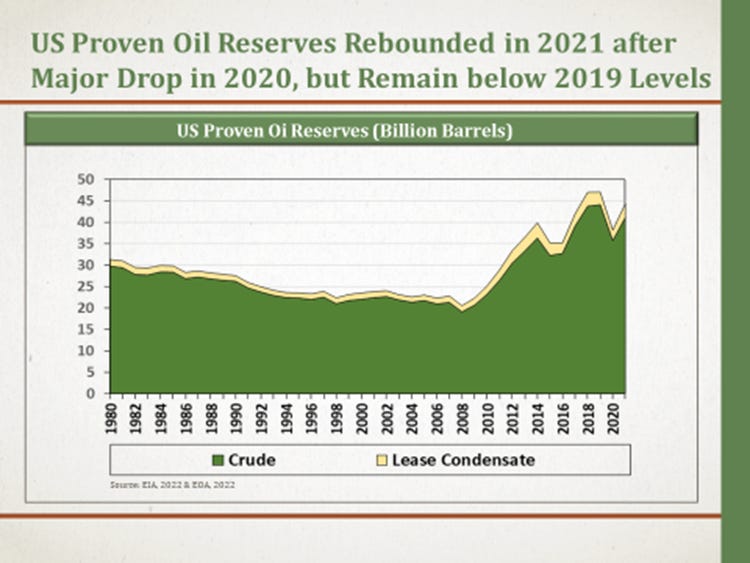

According to the Energy Information Administration (EIA), crude oil and lease condensate reserves in the US increased by 16.2% in 2021, despite the production of 4.1 billion barrels. They increased from 38.2 billion barrels at the end of 2020 to 44.4 at the end of 2021. Most of the increase came from extensions and discoveries.

IN CHARTS: World Oil Reserves

Figure (7)

Figure (8)

Figure (9)

Figure (10)

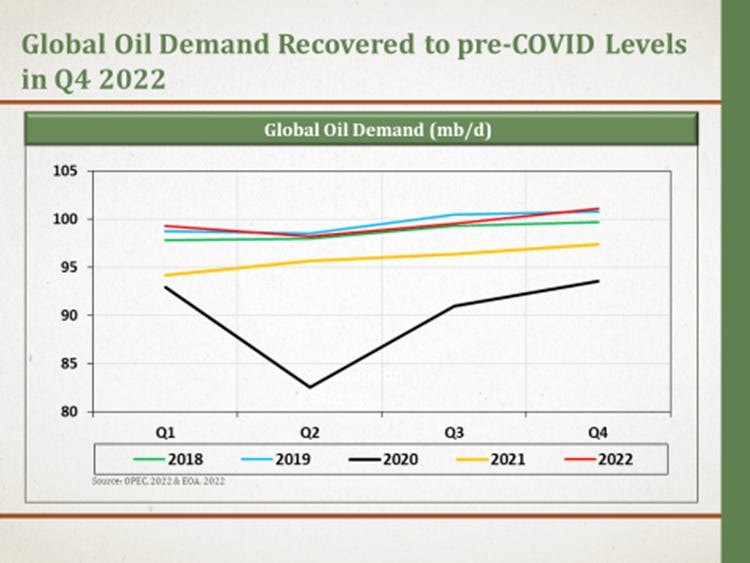

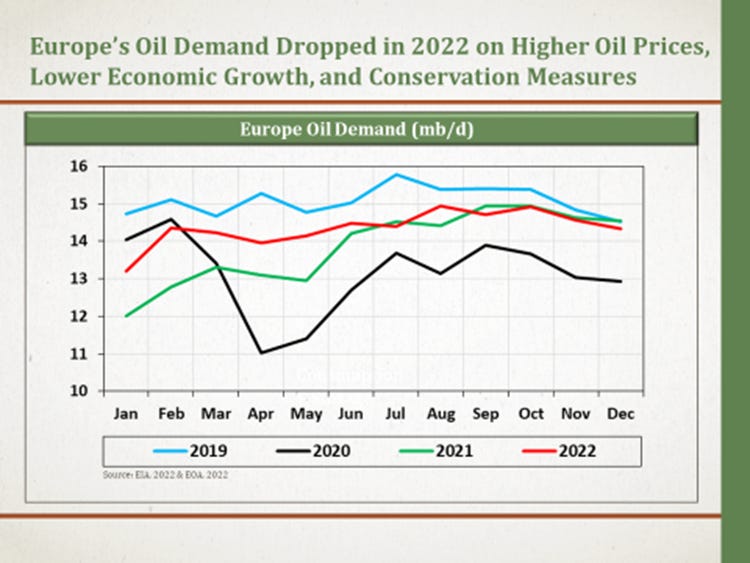

World Oil Demand

World oil demand increased by 2.5 mb/d (2.6%) in 2022 to 99.6 mb/d, according to OPEC estimates. Actual growth in world oil demand was lower than earlier forecasts. For example, OPEC predicted world oil demand to grow by 4.2 mb/d in its report published in Dec 2021. The difference between forecasts and the actual growth was large: 1.7 mb/d!

After a downward revision, the IEA predicted in its report published in Dec 2021 that world oil demand would grow by 3.3 mb/d in 2022. However, the growth in 2022 according to the IEA was 1 mb/d lower at 2.3 mb/d.

Figure (11) illustrates the trends in global oil demand since 2018. It shows that global demand has recovered to pre-COVID levels.

Figure (11)

Most of the increase in demand was the result of the recovery from COVID which ended lockdowns in the US, Europe, India, and other countries as shown in Table (1). Demand contracted in China because of the lockdowns, as well as in Russia and the Eurasia region because of the Russian invasion of Ukraine. Oil demand in the Middle East, meanwhile, grew by 430,000 b/d because of the end of lockdowns and higher oil revenues that increased spending.

Table (1)

World Oil Demand in 2021 and 2022

Source: OPEC, 2022 & EOA, 2022

Figure (12)

Figure (13)

Figure (14)

Figure (15)

Figure (16)

World Oil Production

Before we discuss oil production in 2022, we would like to highlight a few terms:

There is a difference between “production” and “supply”. Oil in the SPR is oil produced in past years. Releasing oil from the SPR is an increase in supply, but not an increase in production. A reduction in commercial oil inventories to meet demand implies supplies are higher than production.

There is a difference between “actual OPEC production” and the “call on OPEC”. The first is actual production, while the second is what OPEC should produce to fill the gap between global oil demand and non-OPEC production. Actual production could be higher, lower, or equal to the call on OPEC.

There is a difference between the OPEC+ production ceiling (quota or production target) and actual production. OPEC+ production decisions focus on the production ceiling, not actual production. A case in point is when OPEC+ decided in early October 2022 to cut production by 2 mb/d—this was from the production ceiling. The actual production cut was way lower since many countries could not meet their quotas in 2022.

Demand numbers include all liquids: crude, condensate, NGLs, refinery gains, and biofuel. Most production numbers focus on crude and lease condensates. One of the emerging problems now is that crude oil production numbers include NGLs!

Production in 2022

Global liquids production increased by an average of 4.31 mb/d in 2022 compared to 2021 (4.5% increase), and reached pre-COVID levels towards the end of 2022. Non-OPEC liquids production increased by 1.89 mb/d from 63.68 mb/d in 2021 to 65.57 mb/d in 2022, according to OPEC estimates. OPEC crude oil production increased by 2.59 mb/d from 26.34 mb/d in 2021 to 28.94 mb/d in 2022. The difference between world demand and OPEC and non-OPEC production in 2022 is biofuels, OPEC NGLs, and oil from the SPR.

Figure (17)

Figure (18)

Figure (19)

Figure (20)